Stock Market Trader

Considering the significant fall in volatility, may be with the hope of easing geopolitical tensions a bit and continuation of higher highs, higher lows formation along with the index trading above all key moving averages, the market may continue its northward journey in the coming sessions with resistance at 22,400 (which coincides with the 61.8 percent Fibonacci retracement) and 22,500 levels on the Nifty, experts said. The 22,200 level can act as a support to the index, they added.

On April 23, the benchmark indices faced profit booking at higher levels and closed the volatile session with moderate gains, extending the upward journey for third consecutive session. The BSE Sensex rose 90 points to 73,738, while the Nifty 50 climbed 32 points to 22,368 and formed bearish candlestick pattern on the daily charts as the closing was lower than opening levels.

"A minor resistance at the 61.8 percent Fibonacci retracement around 22,400 in the Nifty is expected to overcome, leading to a rally towards 22,500-22,600 levels," Om Mehra, technical analyst at Samco Securities said.

The RSI (relative strength index) is holding the 50 level strongly. Immediate support remains at 22,250 and any short-term retracement will be seen as a buying opportunity, he said.

The options data also indicated that 22,400-22,500 is expected to be hurdle where decent open interest has seen. The immediate support for the index is placed around 22,200 followed by 22,030-22,000 zone, Ruchit Jain, lead research at 5paisa.com said.

The market breadth remained positive for yet another session as three shares advanced for every two falling shares on the NSE.

Meanwhile, the India VIX, the domestic gauge for volatility, has dipped 19.72 percent to 10.2, the lowest level in nearly 9 months, which provided comfort to bulls.

Story continues below Advertisement

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty, and Bank Nifty

The pivot point calculator indicates that the Nifty 50 is expected to face resistance at the 22,426 level followed by the 22,449 and 22,487 levels. On the lower side, the index may take immediate support at the 22,351 level followed by 22,328 and 22,290 levels.

On April 23, the Bank Nifty remained volatile after a positive opening, with bears having dominance at higher levels, and closed 46 points higher at 47,970. The index has formed bearish candlestick pattern on the daily charts.

"Despite this, the overall sentiment remains bullish, suggesting that dips should be seen as buying opportunities. Strong support is observed around the 47,800-47,700 zone," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

However, the immediate hurdle lies at 48,200-48,500. A breakthrough above this resistance could pave the way for the index to achieve fresh all-time high levels, he feels.

According to the pivot point calculator, the Bank Nifty index may see resistance at 48,212, followed by 48,307 and 48,461. On the lower side, the index is expected to take support at 47,903, followed by 47,808 and 47,654.

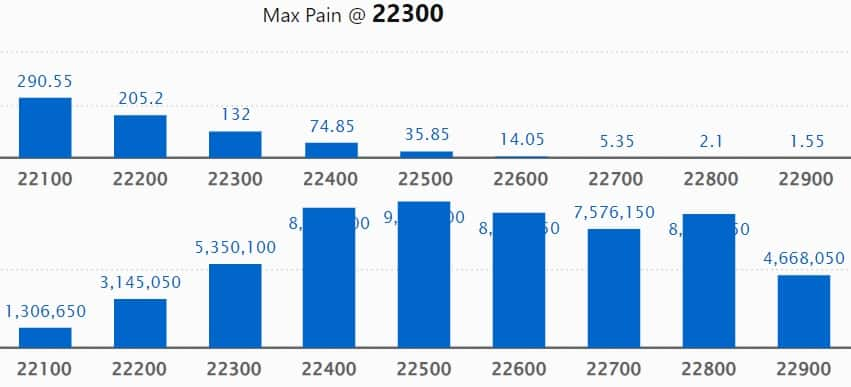

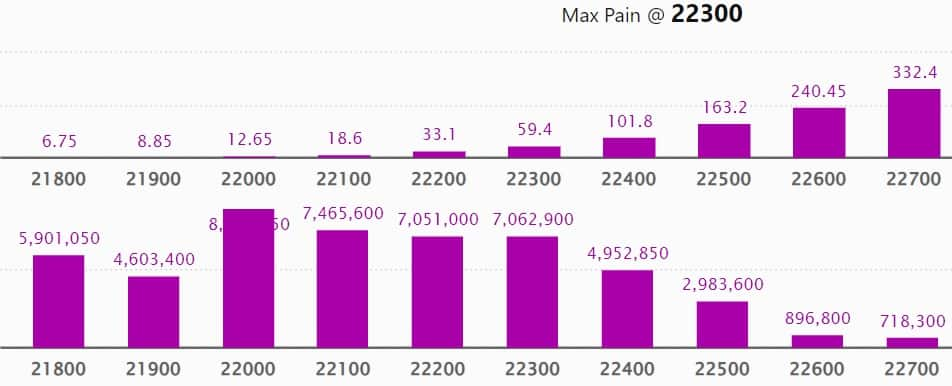

As per the monthly options data, the maximum Call open interest was seen at 23,000 strike, with 1.22 crore contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,500 strike, which had 93.1 lakh contracts, while the 22,400 strike had 88.62 lakh contracts.

Meaningful Call writing was seen at the 22,400 strike, which added 34.89 lakh contracts followed by 22,800 strike and 22,700 strike, which added 25.91 lakh and 21.8 lakh contracts, respectively.

The maximum Call unwinding was at the 22,000 strike, which shed 4.68 lakh contracts followed by 22,200 and 22,100 strikes, which shed 3.68 lakh contracts and 3.25 lakh contracts, respectively.

On the Put side, the 22,000 strike owned the maximum open interest, which can act as a key support level for the Nifty with 88.16 lakh contracts. It was followed by the 21,500 strike comprising 81.52 lakh contracts and then the 22,100 strike with 74.65 lakh contracts.

Meaningful Put writing was at the 22,100 strike, which added 33.43 lakh contracts followed by the 22,400 strike and 21,500 strike adding 25.66 lakh and 18.68 lakh contracts, respectively.

Put unwinding was seen at 21,300 strike, which shed 16.51 lakh contracts followed by 22,000 and 21,200 strikes, which shed 13.13 lakh and 3.51 lakh contracts, respectively.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Vodafone Idea, Balkrishna Industries, Pidilite Industries, Kotak Mahindra Bank, and PI Industries saw the highest delivery among the F&O stocks.

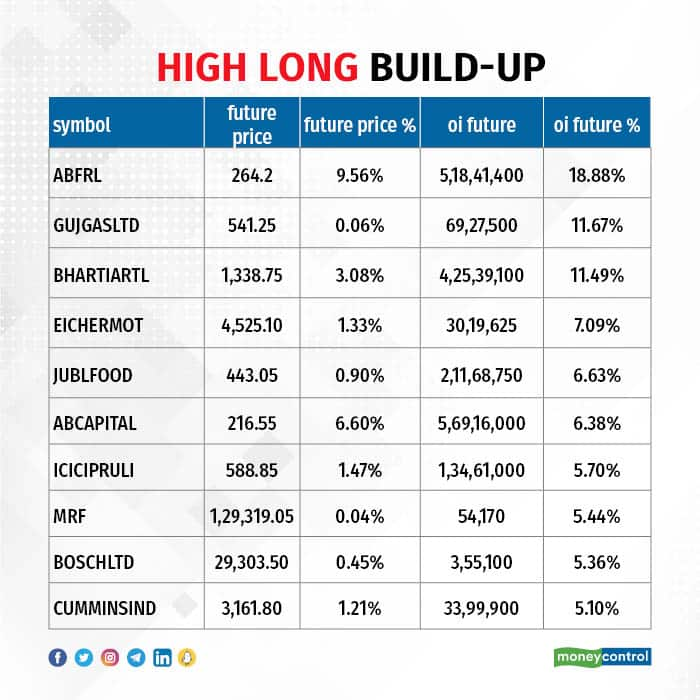

A long build-up was seen in 44 stocks, which included Aditya Birla Fashion & Retail, Gujarat Gas, Bharti Airtel, Eicher Motors, and Jubilant Foodworks. An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 40 stocks saw long unwinding, which included Exide Industries, Hindustan Copper, Hindalco Industries, Dr Lal PathLabs, and Punjab National Bank. A decline in OI and price indicates long unwinding.

26 stocks see a short build-up

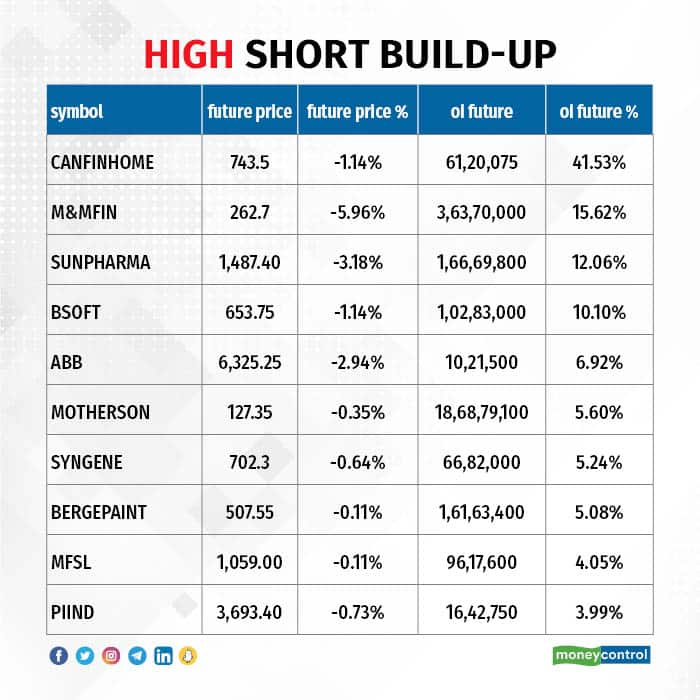

A short build-up was seen in 26 stocks, including Can Fin Homes, Mahindra & Mahindra Financial Services, Sun Pharmaceutical Industries, Birlasoft, and ABB India. An increase in OI, along with a fall in price points to a build-up of short positions.

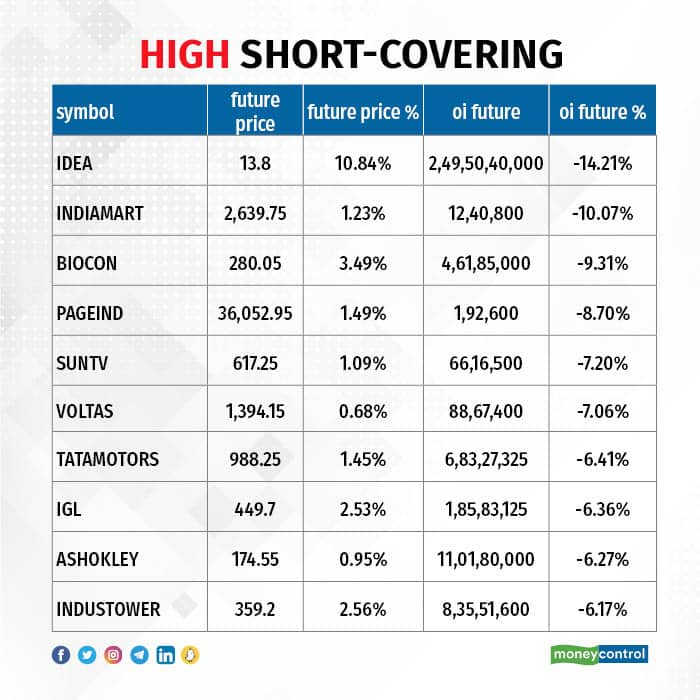

Based on the OI percentage, a total of 74 stocks were on the short-covering list which included Vodafone Idea, IndiaMART InterMESH, Biocon, Page Industries, and Sun TV Network. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, declined to 1.06 on April 23, from 1.14 levels in the previous session.

The increasing PCR or higher than 0.7 or surpassing 1 means the traders are selling more Put options than Calls options, which generally indicates increasing bullish sentiment in the market, whereas the ratio falling below 0.7 or moving down towards 0.5 means that selling in Calls is higher than selling Puts, indicating the bearish sentiment in the market.

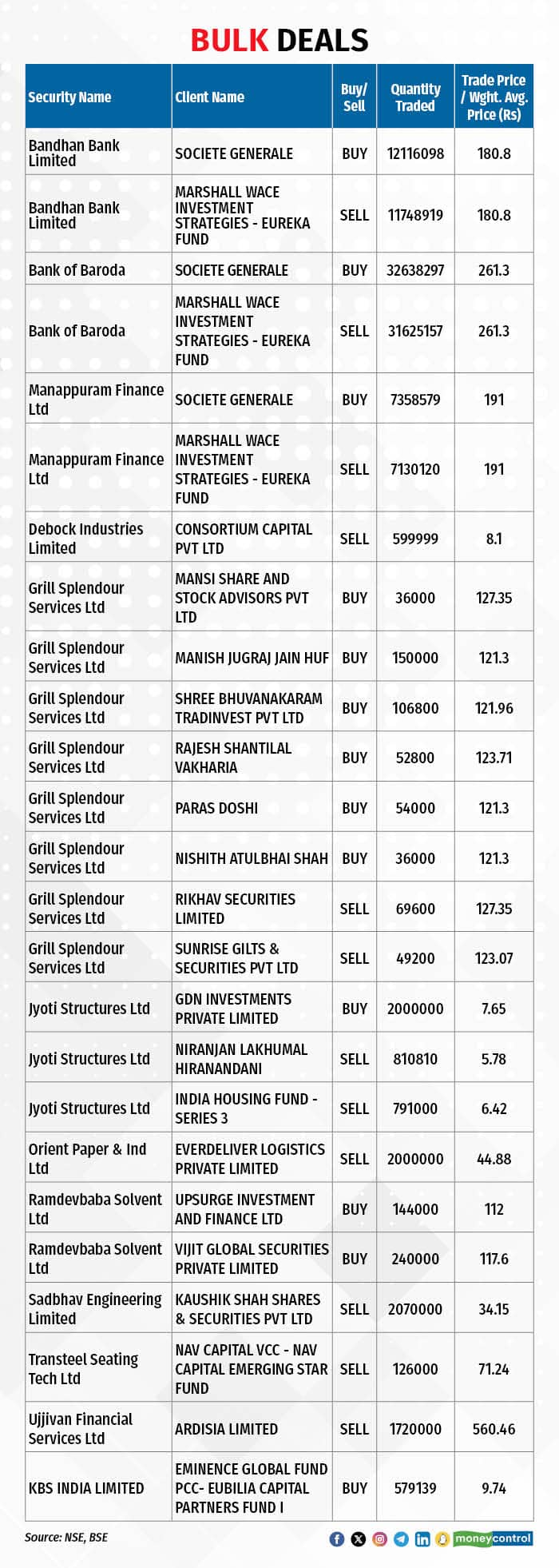

For more bulk deals, click here

Stocks in the news

Tata Consumer Products: The FMCG company has recorded consolidated net profit at Rs 268 crore for quarter ended March FY24, declining sharply by 23 percent compared to same period last fiscal despite healthy operating numbers, and topline, impacted by exceptional loss of Rs 216 crore. Revenue from operations grew by 9 percent on-year to Rs 3,927 crore for the quarter.

ICICI Prudential Life Insurance Company: The life insurance company has registered profit after tax at Rs 174 crore for March FY24 quarter, declining 26 percent compared to corresponding period of previous fiscal. Value of new business (VNB) declined by 26.4 percent year-on-year to Rs 776 crore during the quarter and VNB margin was down 1,050 bps at 21.5 percent in the same period.

Tata Elxsi: The Tata Group company has reported a 4.6 percent on-year decline in net profit at Rs 196.9 crore for quarter ended March FY24 on lower topline and weak operating numbers. Revenue from operations fell 0.9 percent year-on-year to Rs 905.9 crore during the quarter.

Gokaldas Exports: The company has raised Rs 600 crore via allotment of 77,41,935 equity shares to eligible qualified institutional buyers, at issue price of Rs 775 per share.

Cyient DLM: The electronics manufacturing solutions provider has recorded consolidated net profit at Rs 22.7 crore for March FY24 quarter, growing significantly by 80.7 percent over same period previous fiscal despite weak operating margin, driven by other income and topline. Revenue from operations increased by 30.5 percent year-on-year to Rs 361.8 crore during the quarter.

IIFL Finance: The special audit directed by the Reserve Bank of India (RBI) has commenced on April 23. The RBI on March 4 had suspended the disbursement of new gold loans by the company until the satisfactory completion of the said audit. This measure was part of RBI’s supervisory action over concerns related to certain loan disbursement practices.

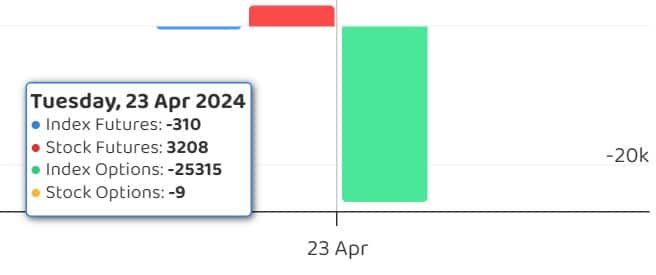

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net sold shares worth Rs 3,044.54 crore, while domestic institutional investors (DIIs) bought Rs 2,918.94 crore worth of stocks on April 23, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has retained Hindustan Copper, Vodafone Idea, and Zee Entertainment Enterprises to the F&O ban list for April 24. Biocon, Piramal Enterprises, and SAIL were removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

"trade" - Google News

April 23, 2024 at 11:13PM

https://ift.tt/WNtCIMf

Trade setup for Wednesday: 15 things to know before opening bell - Moneycontrol

"trade" - Google News

https://ift.tt/KFJbljw

Tidak ada komentar:

Posting Komentar