- Commodities

- Cryptocurrencies

- Mining

- Economy

- Conferences

- Opinion

Gold up in choppy trade after U.S. GDP data hints stagflation

Kitco News

The Leading News Source in Precious Metals

Kitco NEWS has a diverse team of journalists reporting on the economy, stock markets, commodities, cryptocurrencies, mining and metals with accuracy and objectivity. Our goal is to help people make informed market decisions through in-depth reporting, daily market roundups, interviews with prominent industry figures, comprehensive coverage (often exclusive) of important industry events and analyses of market-affecting developments.

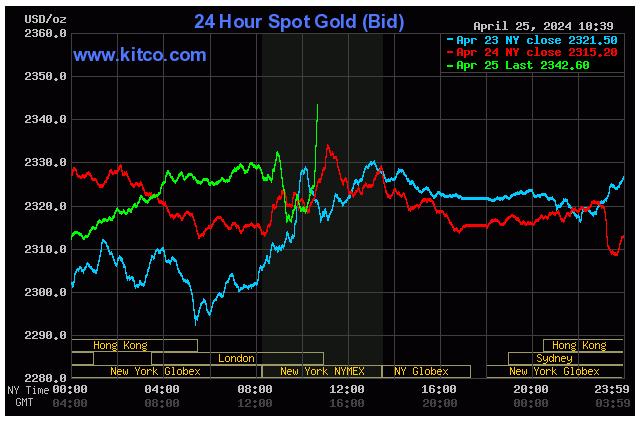

(Kitco News) - Gold prices are a bit higher and silver prices a bit lower in midday U.S. trading Thursday. Trading has been choppy and on both sides of unchanged for the two precious metals today, following a U.S. growth domestic product report that showed mixed components and surprised the marketplace. Gold and silver bulls are still working to put an end to the present downside price corrections. June gold was last up $4.10 at $2,342.10. May silver was last down $0.036 at $27.31.

The U.S. data point of the day saw the advance estimate for first-quarter GDP come in at up 1.6%, year-on-year, which was well below market expectations for a rise of 2.4% and compares to a rise of 3.4% in the fourth quarter of last year. Meantime, the core PCE inflation index rose 3.7% in the same period, compared to expectations for a rise of 3.4%. Some analysts and economists saw today’s GDP data as showing “stagflation,” which is slowing economic growth and higher inflation. Others saw the beginning of the “soft landing” for the U.S. economy that has been talked about for the past year. The slowing GDP growth was bullish for the precious metals, but the higher inflation readings were bearish. The GDP data pushed the benchmark 10-year U.S. Treasury note to a five-high-high yield of 4.71%. While U.S. economic growth did slow down in the first quarter, the still-sticky inflation readings are likely to prevent the Federal Reserve from raising interest rates any time soon. More U.S. PCE inflation data is out on Friday morning and will be closely scrutinized.

U.S. stock indexes are solidly lower near midday, following the GDP report that hinted of stagflation.

The key outside markets today see the U.S. dollar index modestly lower. Nymex crude oil prices are a bit weaker and trading around $82.50 a barrel.

Technically, June gold futures bulls have the firm overall near-term technical advantage. They are keeping alive a nine-week-old uptrend on the daily bar chart. Bulls’ next upside price objective is to produce a close above solid resistance at $2,400.00. Bears' next near-term downside price objective is pushing futures prices below solid technical support at $2,250.00. First resistance is seen at today’s high of $2,357.60 and then at $2,370.00. First support is seen at today’s low of $2,316.40 and then at this week’s low of $2,304.60. Wyckoff's Market Rating: 7.0.

May silver futures bulls have the firm overall near-term technical advantage. A two-month-old price uptrend on the daily bar chart is still alive. Silver bulls' next upside price objective is closing prices above solid technical resistance at $29.00. The next downside price objective for the bears is closing prices below solid support at $25.00. First resistance is seen at today’s high of $27.61 and then at $28.00. Next support is seen at today’s low of $27.00 and then at this week’s low of $26.715. Wyckoff's Market Rating: 7.0

May N.Y. copper closed up 555 points at 451.30 cents today. Prices closed nearer the session high today and hit a nearly two-year high. The copper bulls have the solid overall near-term technical advantage. Prices are in a nine-week-old uptrend on the daily bar chart. Copper bulls' next upside price objective is pushing and closing prices above solid technical resistance at 470.00 cents. The next downside price objective for the bears is closing prices below solid technical support at 430.00 cents. First resistance is seen at today’s high of 455.60 cents and then at 460.00 cents. First support is seen at today’s low of 443.60 cents and then at this week’s low of 438.60 cents. Wyckoff's Market Rating: 8.0.

Jim Wyckoff

Jim Wyckoff has spent over 25 years involved with the stock, financial and commodity markets. He was a financial journalist with the FWN newswire service for many years, including stints as a reporter on the rough-and-tumble commodity futures trading floors in Chicago and New York. As a journalist, he has covered every futures market traded in the U.S., at one time or another.

Jim is the proprietor of the "Jim Wyckoff on the Markets" analytical, educational and trading advisory service. Jim also worked as a technical analyst for Dow Jones Newswires and as the senior market analyst with TraderPlanet.com. Jim is also a consultant with the highly respected "Pro Farmer" agricultural advisory service. Jim was also the head equities analyst at CapitalistEdge.com. He received his degree from Iowa State University in Ames, Iowa, where he studied journalism and economics.

Follow Jim daily on Kitco.com as he provides both AM and PM roundups and a daily Technical Special. 1 877 963-NEWS jwyckoff at kitco.com

"trade" - Google News

April 25, 2024 at 11:28PM

https://ift.tt/OtCHNuq

Gold up in choppy trade after U.S. GDP data hints stagflation - Kitco NEWS

"trade" - Google News

https://ift.tt/KFJbljw

Tidak ada komentar:

Posting Komentar