Equity Market Trend

Despite elevated volatility, bulls seem to be in a position to not easily relinquish control to bears. The Nifty 50 sustained an uptrend for five days in a row and reached near the critical hurdle of 22,600, despite a correction in the Bank Nifty. Furthermore, the index continued to see higher highs formation while trading above all key moving averages, as well as maintaining a positive bias in the momentum indicator RSI (relative strength index placed at 59.12). Hence, the trend remains positive. Experts feel that if the index closes and holds above 22,600 in the coming sessions, then the index's journey towards 22,800 can't be ruled out. Till then, it may consolidate with support at 22,500-22,400 levels.

The Nifty 50 climbed 69 points or 0.51 percent to 22,598 on Wednesday and formed a bullish candlestick pattern with a long lower shadow on the daily charts, indicating support-based buying interest.

Meanwhile, the Bank Nifty extended its correction for the second consecutive session and formed a bearish candlestick pattern with a long lower shadow on the daily timeframe. The index recovered nearly 350 points from the day's low before closing 266 points or 0.55 percent lower at 47,782.

Here are 15 data points we have collated to help you spot profitable trades:

1) Key Levels For The Nifty 50

Resistance based on pivot points: 22,626, 22,661, and 22,716

Support based on pivot points: 22,514, 22,480, and 22,424

Story continues below Advertisement

Special formation: The Nifty 50 continued to hold above the 20-day as well as the 50-day EMA (exponential moving average), which is a positive signal. Further, the 14-day RSI has consistently been rising for the past one week and is not overbought, which is encouraging for bulls.

2) Key Levels For The Bank Nifty

Resistance based on pivot points: 48,036, 48,197, and 48,456

Support based on pivot points: 47,518, 47,358, and 47,098

Resistance based on Fibonacci retracement: 48,482, 48,833

Support based on Fibonacci retracement: 47,621, 47,471

Special formation: The banking index has negated the higher highs formation seen in the previous six consecutive sessions and closed below the 10-day and 20-day EMAs (exponential moving averages).

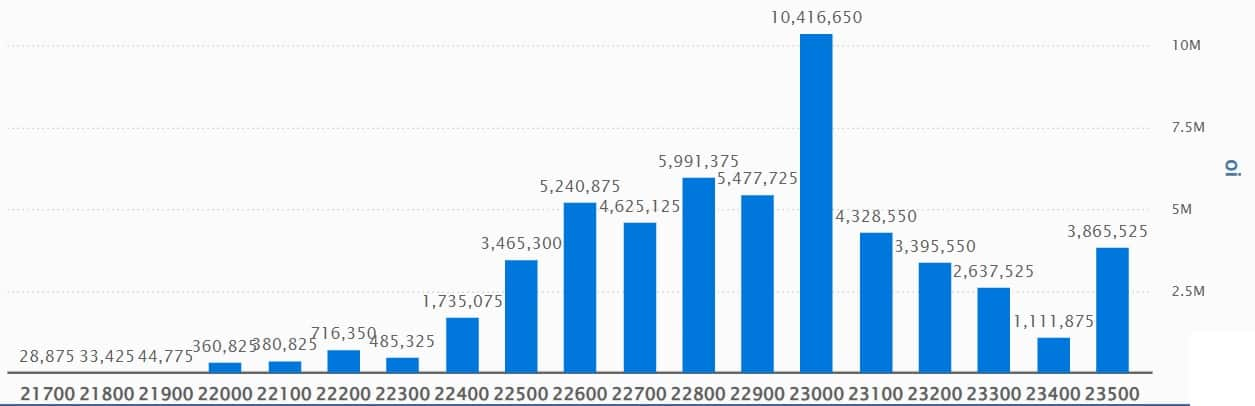

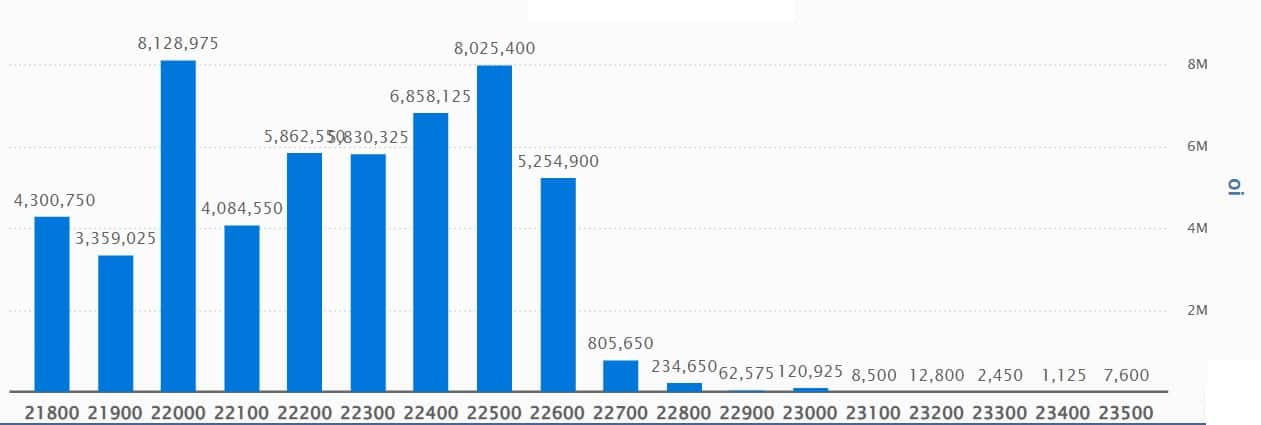

According to the weekly options data, the 23,000 strike continued to own the maximum Call open interest. This level can act as a key resistance level for the Nifty in the short term. It was followed by the 22,800 strike and the 22,900 strike.

Maximum Call writing sustained at the 23,000 strike, followed by the 22,800 and 22,900 strikes, while the maximum Call unwinding was observed at the 22,500 strike, followed by the 23,200 and 23,300 strikes.

On the Put side, the maximum open interest was seen at the 22,000 strike, which can act as a key support level for the Nifty. It was followed by the 22,500 strike, and then the 22,400 strike.

The maximum Put writing was visible at the 22,600 strike, followed by the 22,000 and 22,500 strikes, while the Put unwinding was seen at the 21,600 strike, followed by the 21,700 and 21,300 strikes.

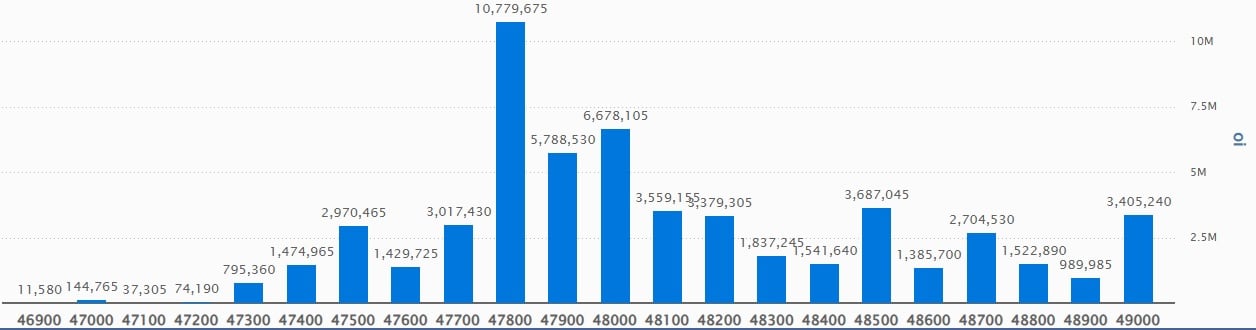

5) Bank Nifty Call Options Data

The 47,800 strike owned the maximum Call open interest, which can act as a key resistance level for the index in the short term. It was followed by the 48,000 strike and the 47,900 strike.

Maximum Call writing was visible at the 47,800 strike, followed by the 47,900 and 48,000 strikes, while the maximum Call unwinding was observed at the 48,300 strike, followed by the 48,400 and 48,900 strikes.

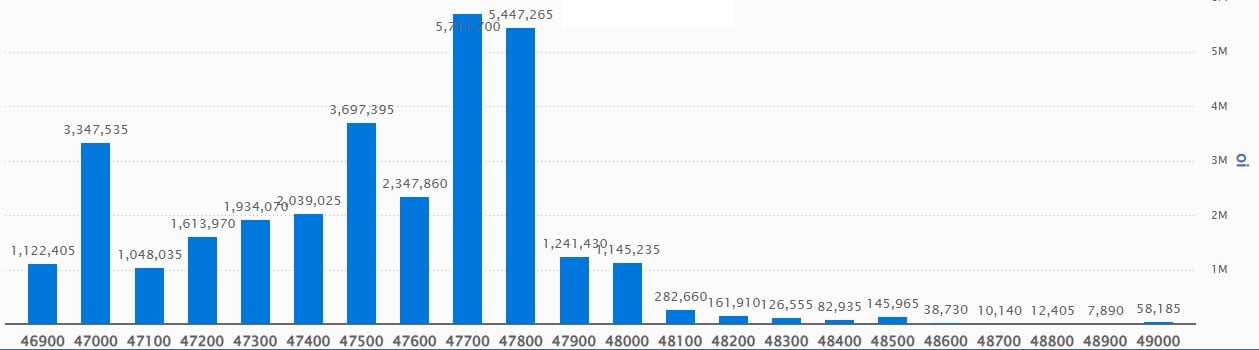

6) Bank Nifty Put Options Data

On the Put side, the maximum open interest was seen at the 47,700 strike, which can act as a key support level for the index. It was followed by the 47,800 strike, and then the 47,500 strike.

The maximum Put writing was observed at the 47,700 strike, followed by the 47,800 and 47,500 strikes, while the maximum Put unwinding was visible at the 48,000 strike, followed by the 48,100 and 48,200 strikes.

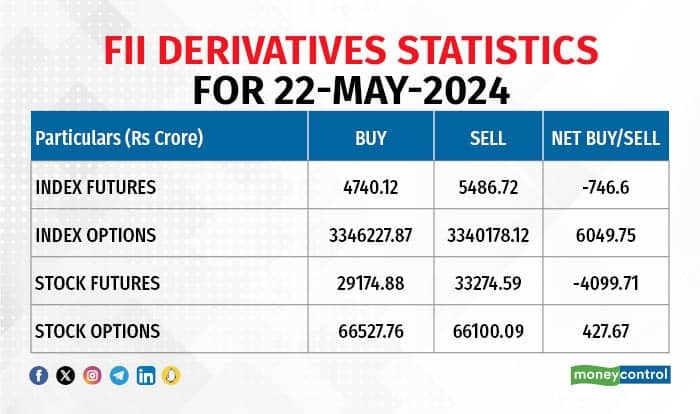

7) Funds Flow (Rs crore)

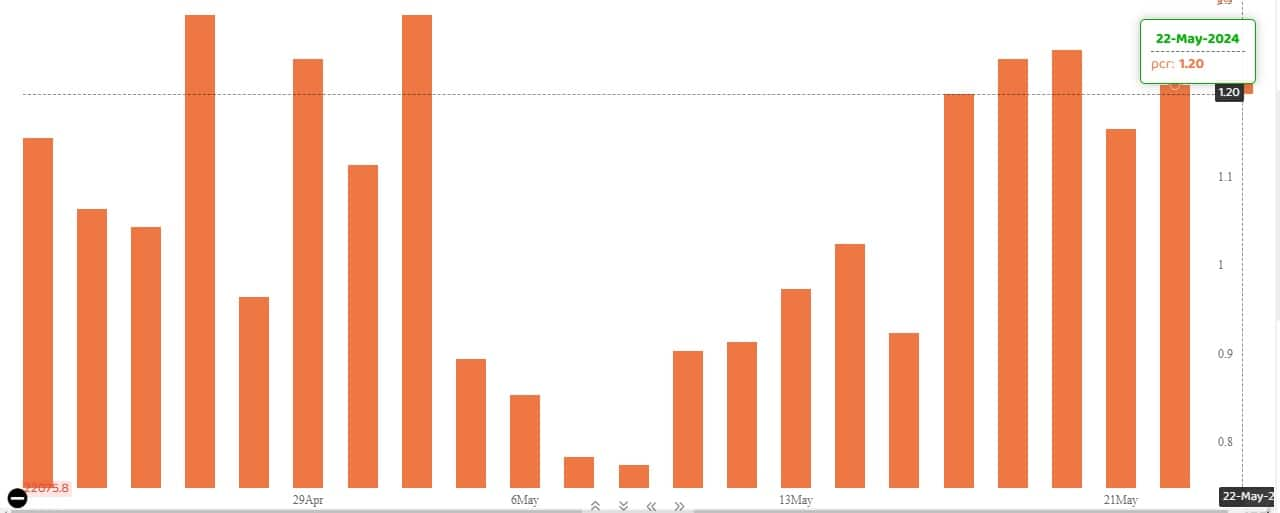

The Nifty Put-Call ratio (PCR), which indicates the mood of the market, rose to 1.20 on May 22 from 1.15 levels in the previous session.

The increasing PCR, or being higher than 0.7 or surpassing 1, means traders are selling more Put options than Call options, which generally indicates the firming up of a bullish sentiment in the market. If the ratio falls below 0.7 or moves towards 0.5, then it indicates selling in Calls is higher than selling in Puts, reflecting a bearish mood in the market.

9) India VIX

Despite cooling down on Wednesday, the volatility remained elevated, suggesting that bulls need to be cautious at the current levels. According to experts, it needs to correct from the current levels to around 15-16 levels for market stability. The India VIX, the fear gauge, fell by 1.57 percent to 21.47 from 21.81 levels.

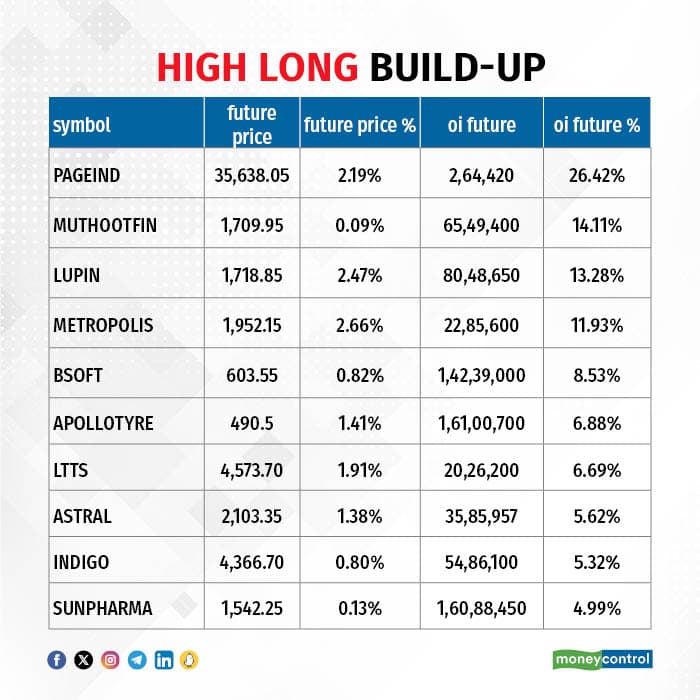

A long build-up was observed in 48 stocks, including Page Industries, Muthoot Finance, Lupin, Metropolis Healthcare, and Birlasoft. An increase in open interest (OI) and price indicates a build-up of long positions.

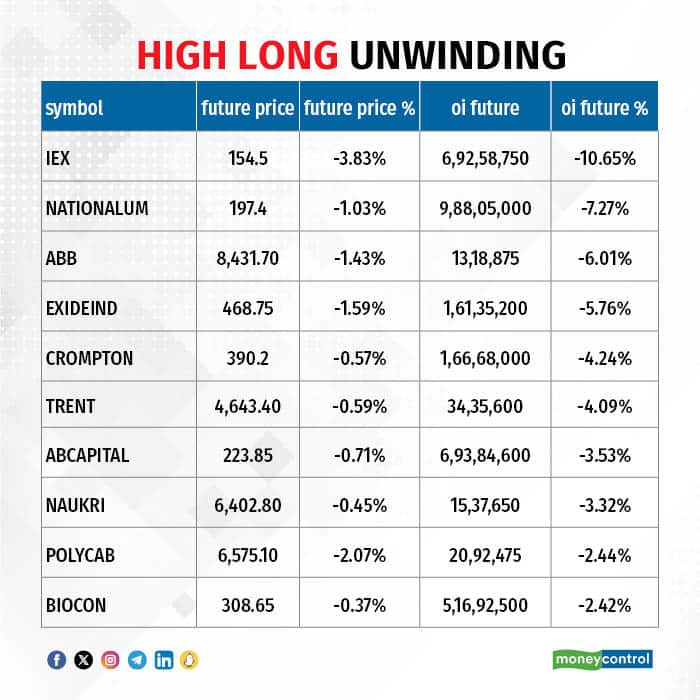

11) Long Unwinding (47 Stocks)

47 stocks saw a decline in open interest (OI) along with a fall in price, indicating long unwinding.

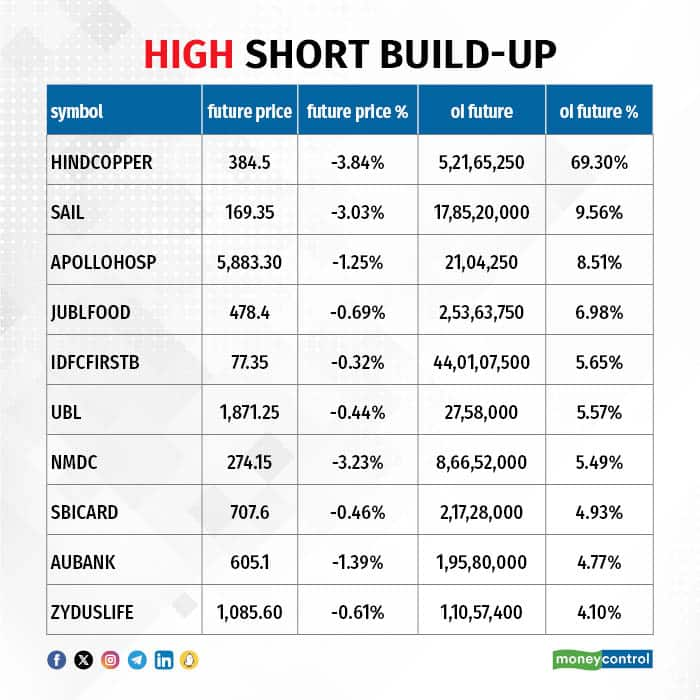

12) Short Build-up (49 Stocks)

49 stocks saw an increase in OI along with a fall in price, indicating a build-up of short positions.

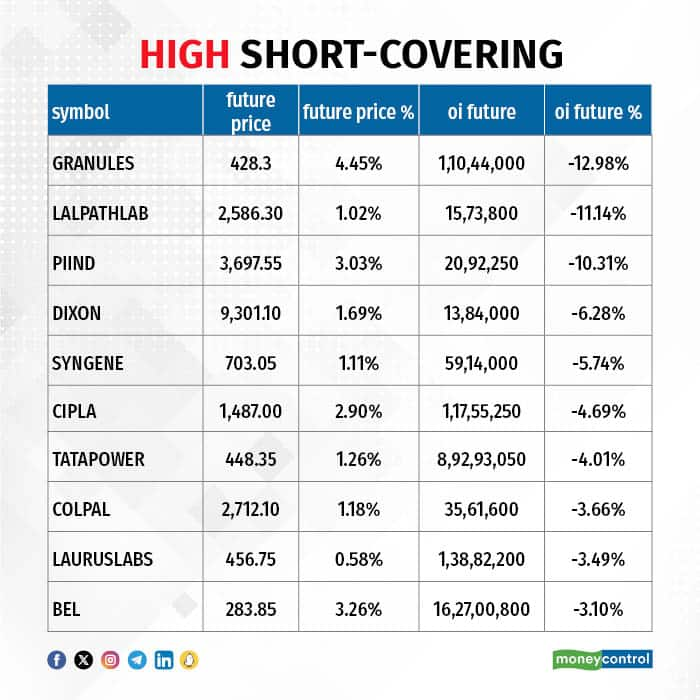

13) Short-Covering (42 Stocks)

42 stocks saw short-covering, meaning a decrease in OI, along with a price increase.

Here are the stocks that saw a high share of delivery trades. A high share of delivery reflects investing (as opposed to trading) interest in a stock.

15) Stocks Under F&O Ban

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Stocks added to F&O ban: Hindustan Copper, Metropolis Healthcare

Stocks retained in F&O ban: Aditya Birla Capital, Balrampur Chini Mills, Bandhan Bank, Biocon, Vodafone Idea, Indian Energy Exchange, India Cements, National Aluminium Company, Piramal Enterprises, Punjab National Bank, and Zee Entertainment Enterprises.

Stocks removed from F&O ban: GMR Airports Infrastructure, Granules India

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

"trade" - Google News

May 22, 2024 at 10:01PM

https://ift.tt/cFmLNnv

Trade setup for Thursday: 15 things to know before opening bell - Moneycontrol

"trade" - Google News

https://ift.tt/UJzBRCF

Tidak ada komentar:

Posting Komentar