Nifty is likely to remain volatile with negative bias

After the recent sharp decline, the market remained volatile and is expected to remain rangebound with negative bias in the coming sessions too. In fact, the range has been narrowed with support, so far, remaining at 21,900, which overall suggests that if Nifty 50 decisively breaks down the same support, then the selling pressure may get intensified up to 21,500, while the hurdle on the higher side, in case of rebound, may be seen at 22,200, experts said.

On March 15, the BSE Sensex was down 454 points at 72,643, while the Nifty 50 fell 123 points to 22,023 and formed small bodied bearish candlestick pattern with upper and lower shadows on the daily charts, indicating some sort of volatility, while on the weekly scale, the index corrected for the first time in last five consecutive weeks, down 2 percent and formed long bearish candlestick pattern which resembles Bearish Engulfing kind of pattern on the weekly timeframe.

"Nifty as per weekly chart placed at the edge of moving below the strong support of 20-week EMA around 21,915 levels. This is not a good sign," Nagaraj Shetti, senior technical research analyst at HDFC Securities said.

He feels the short term and the near-term trend of Nifty remains weak. "A decisive move below 21.900 could open sharp weakness down to the next lower support of 21,500 levels in the near term. Immediate resistance is at 22,200 levels," he said.

Further, the Nifty has once again closed below the rising trendline, bringing market sentiment back into a state of weakness. The momentum indicator suggests bearish momentum in the near term. "Immediate support is situated currently at 21,900, which is expected to provide support for the Nifty. A decisive drop below 21,900 could lead to a sharp decline in the index," Rupak De, senior technical analyst at LKP Securities said.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty

Story continues below Advertisement

The pivot point calculator indicates that the Nifty 50 is likely to take immediate support at 21,953, followed by 21,908 and 21,836. On the higher side, the index may face resistance at 22,041, followed by 22,142 and 22,215 levels.

On March 15, the Bank Nifty bears remained in power for sixth consecutive session, falling 196 points to 46,594 and formed Doji candlestick pattern for yet another session on the daily charts, while on the weekly scale, the index has formed long bearish candlestick pattern as it declined 2.6 percent.

"Immediate resistance for the BankNifty index lies at 47,000, coinciding with the 20-day moving average (20DMA). A decisive break above this level could propel the index higher towards the 47,500 mark," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

On the flip side, he feels the lower end support is positioned at 46,500-46,300, where bulls are currently attempting to defend. However, a breach below this level may intensify selling pressure in the market, he said.

As per the pivot point calculator, Bank Nifty is expected to take support at 46,381, followed by 46,265 and 46,077. On the higher side, the index may see resistance at 46,639 followed by 46,873 and 47,061.

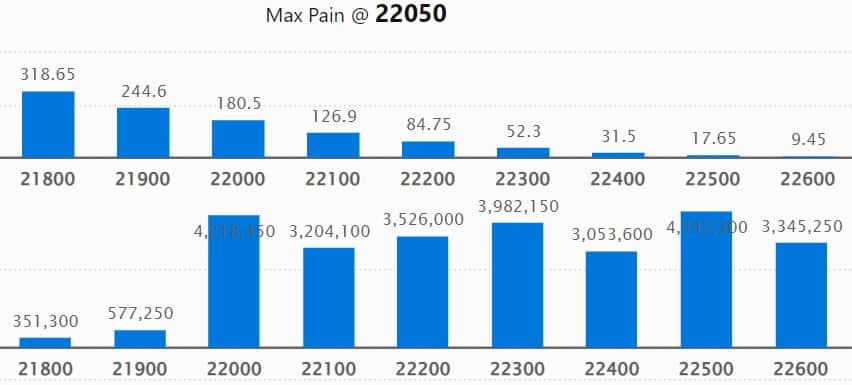

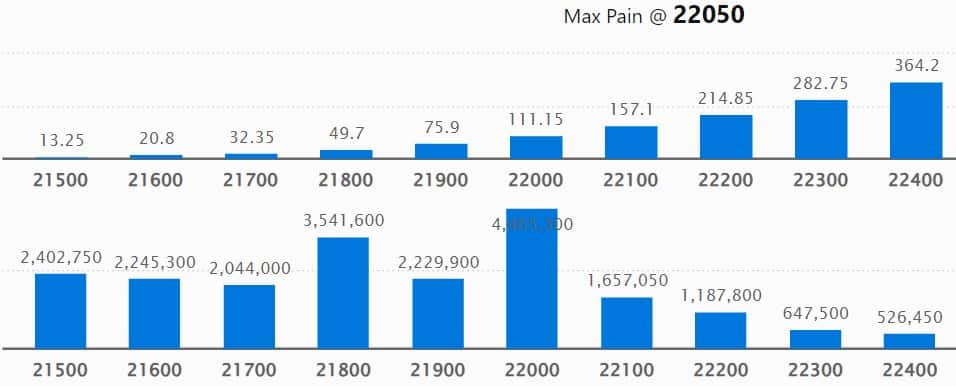

As per the weekly options data, the maximum Call open interest was seen at 23,000 strike with 55.73 lakh contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,500 strike, which had 43.42 lakh contracts, while the 22,000 strike had 42.18 lakh contracts.

Meaningful Call writing was seen at the 22,000 strike, which added 23.38 lakh contracts, followed by 22,100 strike, and 22,300 strike, which added 21.96 lakh and 18.85 lakh contracts, respectively.

The maximum Call unwinding was at the 21,000 strike, which shed 1,000 contracts, followed by 20,700 strike, which shed 150 contracts.

On the Put side, the 21,000 strike owned the maximum open interest, which can act as a key support level for the Nifty, with 47.61 lakh contracts. It was followed by the 22,000 strike comprising 44.65 lakh contracts and then at the 21,800 strike with 35.41 lakh contracts.

Meaningful Put writing was at the 21,000 strike, which added 19.31 lakh contracts followed by the 21,800 strike and 21,200 strike, which added 17.09 lakh and 12.08 lakh contracts.

Put unwinding was seen at 22,200 strike, which shed 5.92 lakh contracts, followed by 22,500 and 22,300 strikes, which shed 1.86 lakh and 1.51 lakh contracts, respectively.

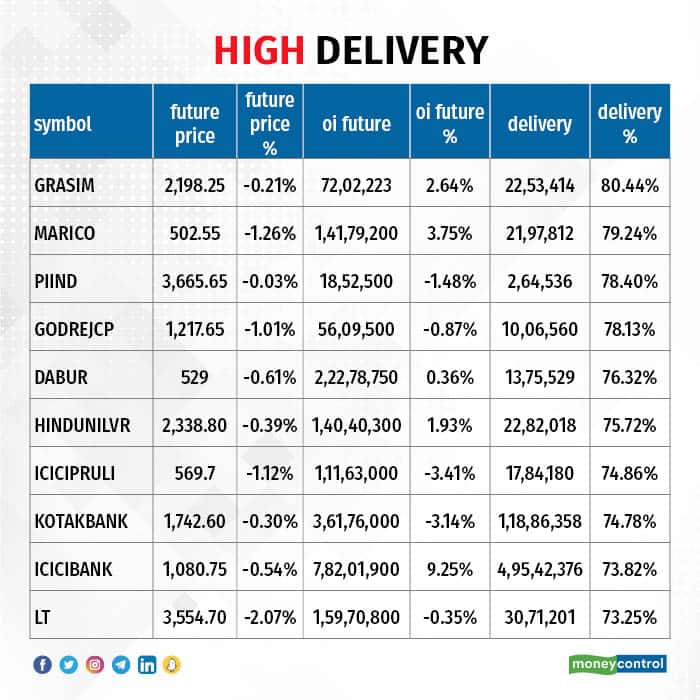

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Grasim Industries, Marico, PI Industries, Godrej Consumer Products, and Dabur India saw the highest delivery among the F&O stocks.

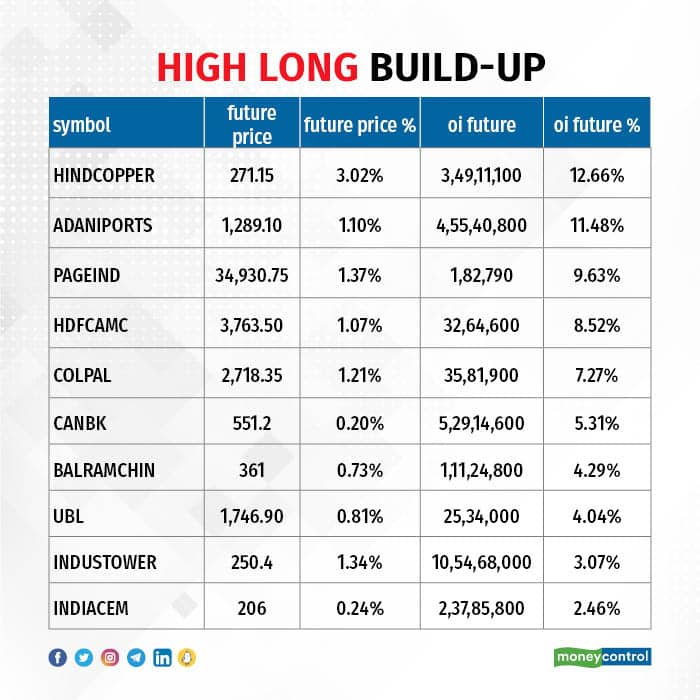

A long build-up was seen in 22 stocks, which included Hindustan Copper, Adani Ports & Special Economic Zone, Page Industries, HDFC AMC, and Colgate Palmolive. An increase in open interest (OI) and price indicates a build-up of long positions.

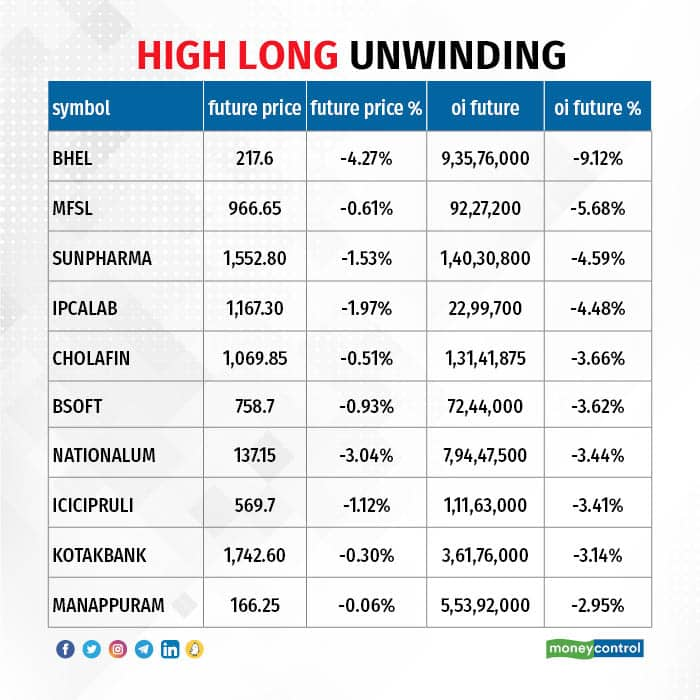

Based on the OI percentage, 52 stocks saw long unwinding. These include BHEL, Max Financial Services, Sun Pharmaceutical Industries, Ipca Laboratories, and Cholamandalam Investment & Finance. A decline in OI and price indicates long unwinding.

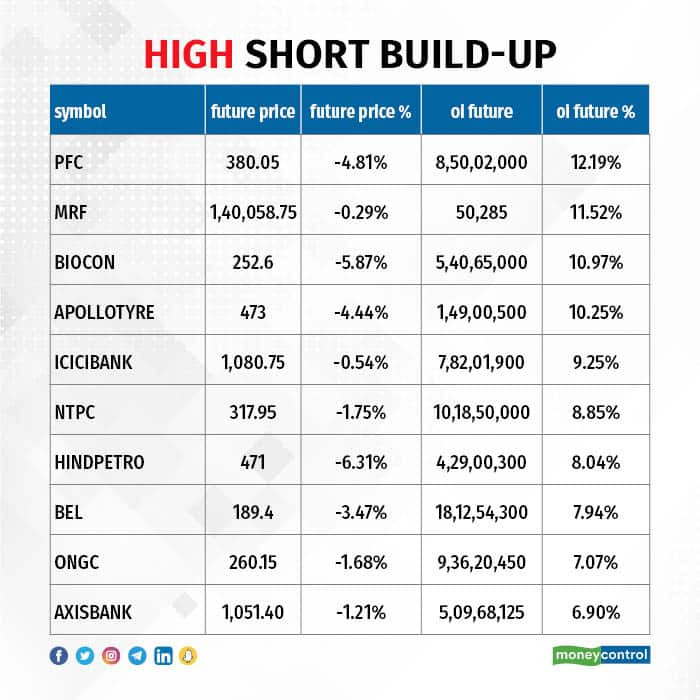

69 stocks see a short build-up

A short build-up was seen in 69 stocks, including PFC, MRF, Biocon, Apollo Tyres, and ICICI Bank. An increase in OI along with a fall in price points to a build-up of short positions.

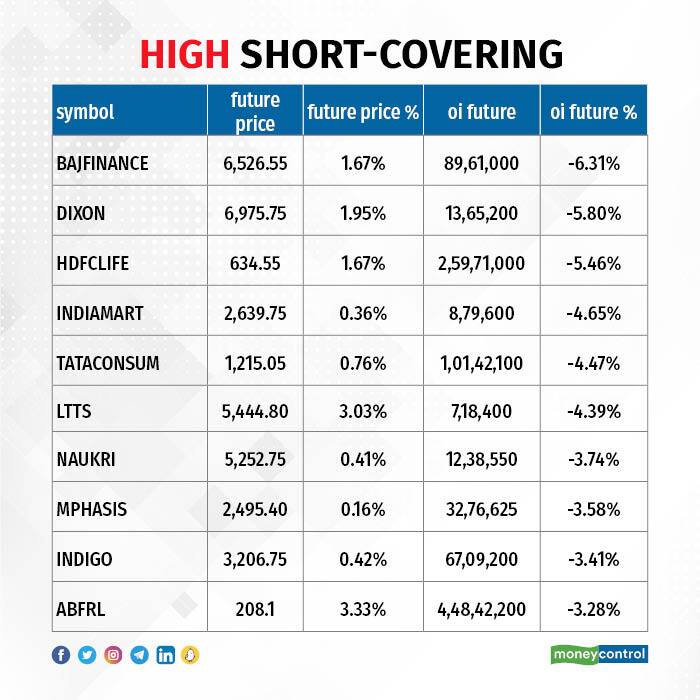

41 stocks see a short covering

Based on the OI percentage, total 41 stocks were on the short-covering list. These included Bajaj Finance, Dixon Technologies, HDFC Life Insurance Company, IndiaMART InterMESH, and Tata Consumer Products. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, dropped to 0.99 on March 15, from 1.12 in the previous session. Below 1 PCR indicates that the trading volume of Call options is more than Put options, which generally suggests gradual increase in bullish market trend ahead.

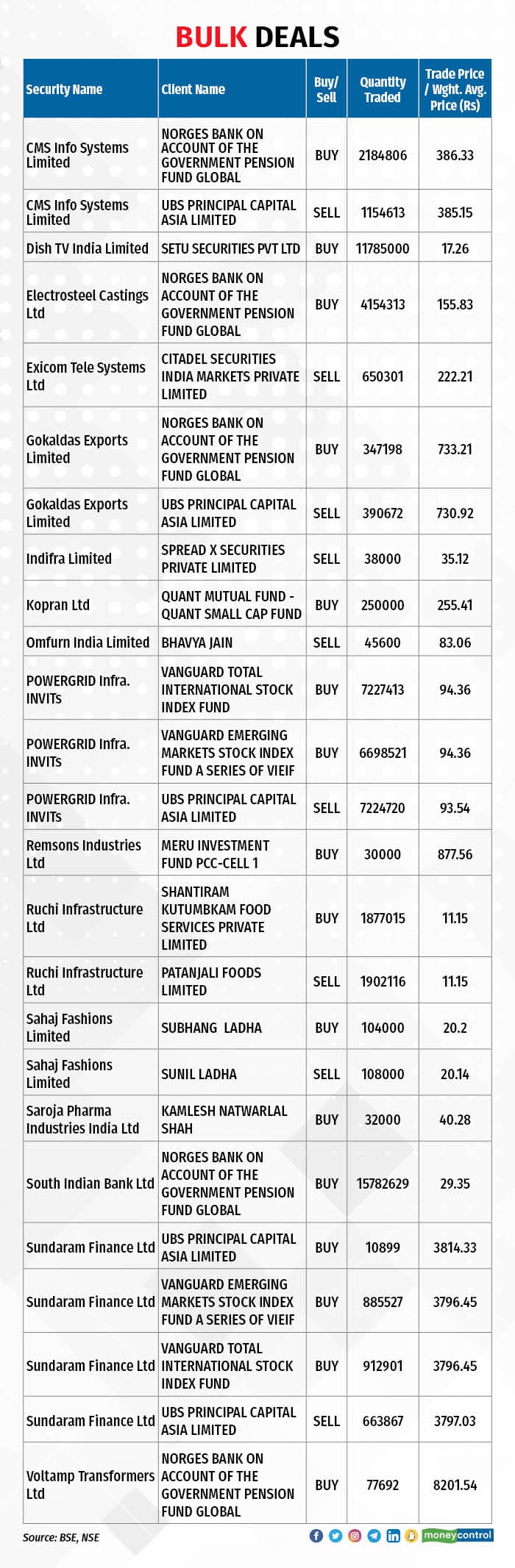

For more bulk deals, click here

Stocks in the news

RailTel Corporation of India: The company has received the work order from Municipal Corporation of Greater Mumbai for supply, installation, testing, commissioning, operations & maintenance of HMIS (health management information system) for Health Department of BMC amounting to Rs 351.95 crore.

Dr Lal PathLabs: The company said board of directors approved the re-designation of Shankha Banerjee by appointing him as Chief Executive Officer (CEO) and key managerial personnel (KMP) with effect from May 21, 2024.

KPI Green Energy: The company has emerged as the successful bidder in the Maharashtra State Power Generation Co (MAHAGENCO) tender for development of 100MWAC solar power project.

Torrent Power: The company has received Letter of Award from Torrent Power's distribution unit for setting up of 300 MW (renewable energy power) GridConnected wind solar hybrid projects.

JSW Energy: Subsidiary JSW Neo Energy has received Letter of Awards (LoA) for an additional 500 MW of wind capacity under greenshoe option for the

SECI wind power projects (Tranche - XVI).

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) net bought shares worth Rs 848.56 crore, while domestic institutional investors (DIIs) sold Rs 682.26 crore worth of stocks on March 15, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has added Biocon, and Hindustan Copper to the F&O ban list for March 18, while retaining Aditya Birla Fashion & Retail, BHEL, Manappuram Finance, National Aluminium Company, Piramal Enterprises, RBL Bank, SAIL, Tata Chemicals and Zee Entertainment Enterprises on the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclosure: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

"trade" - Google News

March 18, 2024 at 12:26AM

https://ift.tt/g0A16bM

Trade setup for today: 15 things to know before opening bell - Moneycontrol

"trade" - Google News

https://ift.tt/rBhaT3u

Tidak ada komentar:

Posting Komentar