21,800 likely to be crucial for further upward journey in Nifty

The market hit a fresh record high on December 28, the expiry day for December futures & options contracts, and continued uptrend for five days in a row with strong volumes. Hence, experts expect the ongoing momentum, especially seen after the recent consolidation breakout, to sustain in the coming days with the Nifty 50 aiming for the psychological 22,000 mark, while the 21,700-21,500 may act as a support zone at the beginning of the January series.

In addition, the index continued higher highs, and higher lows formation four days in a row with the gap up opening in the last two trading days, while the momentum indicator, RSI (relative strength index) and MACD (moving average convergence divergence) maintained positive bias.

On December 28, the BSE Sensex jumped 372 points to 72,410, while the Nifty 50 rose 124 points to 21,779 and formed a bullish candlestick pattern on the daily scale, indicating an uptrend continuation pattern.

"Positive chart patterns like higher tops and bottoms continued on the Nifty as per the daily timeframe chart. Though Nifty placed at all-time highs, still there is no indication of any higher top reversal forming at the new highs," Nagaraj Shetti, senior technical research analyst at HDFC Securities said.

He feels having moved above the initial hurdle of 21,650 levels, the Nifty is expected to advance towards the next overhead resistance of 22,200 levels in the near term, which is near the 100 percent Fibonacci extension of major bottom-top-bottoms. Immediate support is at 21,550 levels, he said.

According to Rajesh Bhosale, technical analyst at Angel One, 21,900 - 22,000 is the immediate hurdle whereas the immediate support shifted higher towards Thursday's bullish gap around 21,675, and 21,500 - 21,480 is seen as a strong support zone.

Meanwhile, considering around 3,000 points (14 percent) move in just two months, traders should secure some profit at higher levels and end the year on a positive note, Rajesh advised.

The broader markets also performed in line with benchmarks as the Nifty Midcap 100 and Smallcap 100 indices gained 0.6 percent and 0.8 percent respectively, while the India VIX retreated a bit after a sharp jump in the previous two days, falling 2.7 percent to the 15.14 levels, giving some comfort for bulls.

Story continues below Advertisement

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

The pivot point calculator indicates that the Nifty is likely to see immediate resistance at 21,800, followed by 21,829 and 21,876 levels, while on the lower side, it can take support at 21,706, followed by 21,676 and 21,629 levels.

On December 28, the Bank Nifty continued to support the benchmark indices, climbing 226 points to 48,509 and forming a Doji kind of candlestick pattern, indicating indecision amongst bulls and bears about the future market trends.

"Buying was seen in selective banking stocks. Now it has to continue to hold above 48,200 levels, to make an up move towards new life high of 49,000 and 49,500 zone, whereas on the downside support shifted higher at 48,200 then 48,000 levels," Chandan Taparia, Senior Vice President | Analyst-Derivatives at Motilal Oswal Financial Services said.

As per the pivot point calculator, the Bank Nifty is expected to see resistance at 48,608, followed by 48,677 and 48,789 levels, while on the lower side, it may take support at 48,384, followed by 48,315 and 48,203 levels.

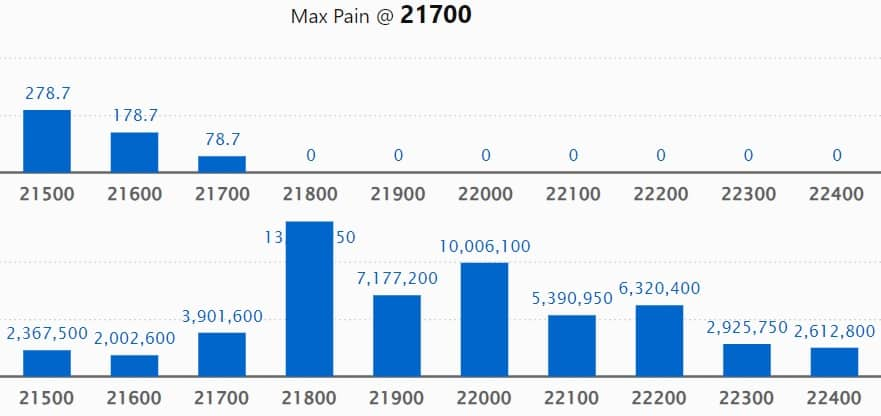

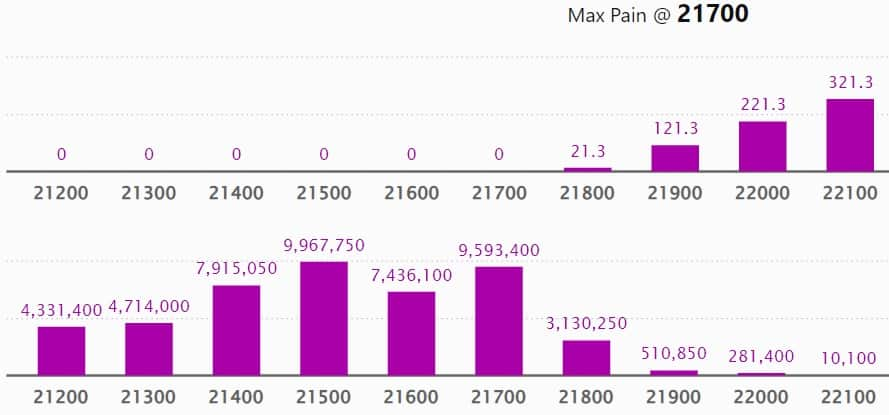

As per the monthly options data, the maximum Call open interest was seen at 21,800 strike with 1.35 crore contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,000 strike, which had 1 crore contracts, while the 21,900 strike had 71.77 lakh contracts.

Meaningful Call writing remained at the 21,800 strike, which added 47.88 lakh contracts followed by 22,200 and 22,700 strikes, which added 23.85 lakh and 13.73 lakh contracts, respectively.

The maximum Call unwinding was at the 22,000 strike, which shed 46.3 lakh contracts followed by 21,700 and 21,600 strikes, which shed 39.27 lakh and 34.71 lakh contracts.

On the Put front, the 21,500 strike continued to show the maximum open interest, which can act as a key support area for the Nifty with 99.67 lakh contracts. It was followed by 21,700 strike comprising 95.93 lakh contracts and 21,000 strike with 94.02 lakh contracts.

Meaningful Put writing was at 21,700 strike, which added 59.35 lakh contracts followed by 21,800 strike and 21,900 strike, which added 24.81 lakh contracts and 3.87 lakh contracts, respectively.

Put unwinding was at 21,500 strike, which shed 36.6 lakh contracts, followed by 21,200 strike and 20,800 strike, which shed 34.97 lakh contracts and 33.88 lakh contracts, respectively.

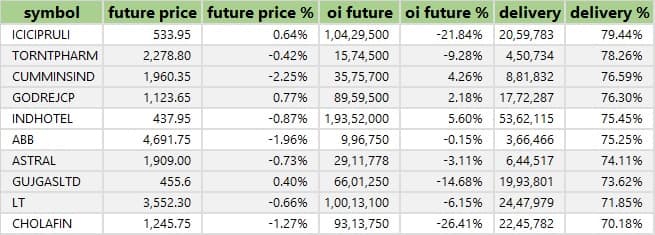

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. ICICI Prudential Life Insurance Company, Torrent Pharmaceuticals, Cummins India, Godrej Consumer Products, and Indian Hotels saw the highest delivery among the F&O stocks.

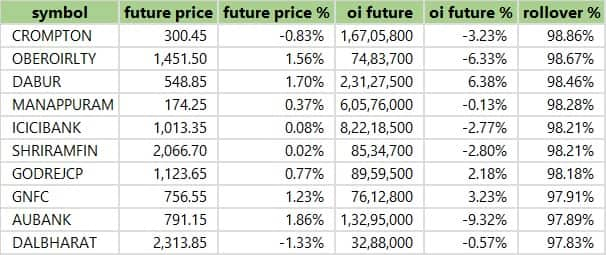

Here are the top 10 stocks which saw the highest rollovers on expiry day including Crompton Greaves Consumer Electricals, Oberoi Realty, Dabur India, Manappuram Finance, and ICICI Bank with over 98 percent rollovers.

A long build-up was seen in 13 stocks, which included Hindustan Copper, Dabur India, Indian Energy Exchange, SAIL, and GNFC (Gujarat Narmada Valley Fertilisers & Chemicals). An increase in open interest (OI) and price indicates a build-up of long positions.

Based on the OI percentage, 51 stocks saw long unwinding, including M&M Financial Services, Cholamandalam Investment & Finance, TVS Motor Company, Vodafone Idea, and UltraTech Cement. A decline in OI and price indicates long unwinding.

A short build-up was seen in 6 stocks including Biocon, Indian Hotels, Adani Enterprises, Cummins India, and Delta Corp. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 114 stocks were on the short-covering list. This included National Aluminium Company, Coromandel International, RBL Bank, Alkem Laboratories, and Tata Communications. A decrease in OI along with a price increase is an indication of short-covering.

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, dropped to 1.30 on December 28, from 1.43 levels in the previous session. The above 1 PCR indicates that the traders are buying more Puts options than Calls, which generally indicates an increase in bearish sentiment.

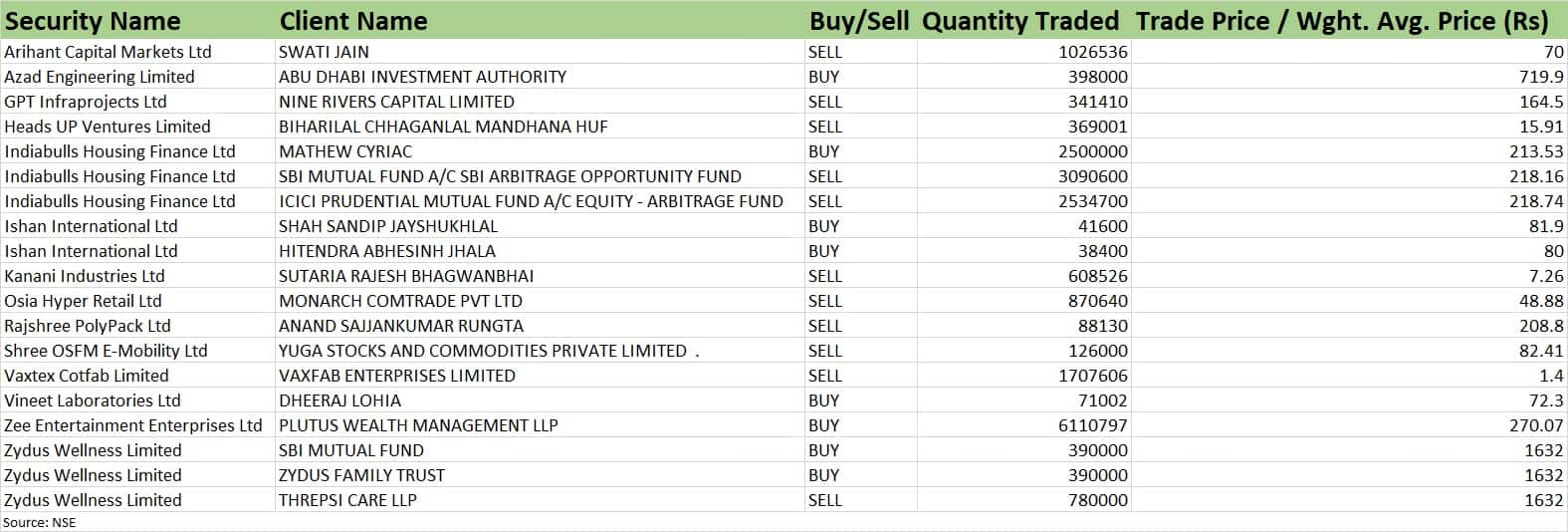

For more bulk deals, click here

Stocks in the news

Innova Captab: The pharmaceutical firm is set to debut on the bourses on December 28. The final issue price has been fixed at Rs 448 per share.

Satin Creditcare Network: The microfinance institution has entered into a master agreement for the co-lending of loans to micro-finance borrowers via a co-lending module in tranches with Karnataka Bank. The company will also act as the service provider and the collections/monitoring will be managed by the company.

Swan Energy: The company said the board has approved the raising of funds up to Rs 4,000 crore through the issuance of equity shares or any other eligible securities.

Federal Bank: The Reserve Bank of India (RBI) has given its approval to ICICI Prudential Asset Management Company (ICICI AMC) for acquiring up to 9.95 percent of the paid-up share capital or voting rights of the Federal Bank.

RBL Bank: The Reserve Bank of India has given its approval to ICICI Prudential Asset Management Company and ICICI Prudential Life Insurance Company, to acquire up to 9.95 percent of the paid-up share capital or voting rights in RBL Bank, within one year i.e. by December 26, 2024.

Tata Coffee: The composite scheme of arrangement amongst Tata Consumer Products (TCPL), Tata Coffee (TCL), and TCPL Beverages & Foods (TBFL) will be effective from January 1, 2024. With the Scheme becoming effective on January 1, 2024, Tata Coffee will get dissolved without winding-up, and accordingly office of all directors and key managerial personnel of the company will stand vacated on that date, without further course of action.

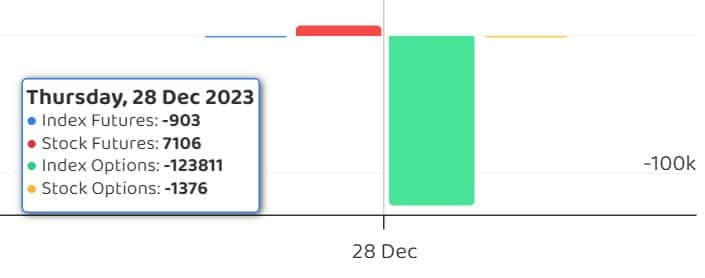

Funds Flow (Rs crore)

Foreign institutional investors (FIIs) bought shares worth Rs 4,358.99 crore, while domestic institutional investors (DIIs) purchased Rs 136.64 crore worth of stocks on December 28, provisional data from the NSE showed.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

"trade" - Google News

December 29, 2023 at 12:15AM

https://ift.tt/W9BRUsd

Trade setup for Friday: 15 things to know before opening bell - Moneycontrol

"trade" - Google News

https://ift.tt/ZydcIs3

Tidak ada komentar:

Posting Komentar