gamagana.blogspot.com

Bulls took a breather, which was on expected lines, after run-up in the previous five consecutive sessions, with the benchmark indices falling marginally on December 29, the first day of January series and final trading day of 2023. Going ahead, the Nifty 50 is expected to consolidate for few more days before getting into strong mood again. Overall, the bulls are still at a healthy position and can lift the index towards 22,000 in the short term, with support at 21,700-21,500 levels, experts said.

On December 29, the BSE Sensex was down 170 points at 72,240, while the Nifty 50 declined 47 points to 21,731 and formed Doji candlestick pattern on the daily scale, indicating indecision amongst bulls and bears about future market trend.

Story continues below Advertisement

"Normally, such formations after a reasonable rise alert for trend reversal. But, having formed this pattern beside the bull candle of Thursday, one may expect range-bound action or consolidation movement to continue in the market," Nagaraj Shetti, senior technical research analyst, HDFC Securities said.

A long bull candle was formed on the weekly chart, that has surpassed the high wave type candle pattern of the previous week. This is a positive indication, he feels.

Hence, he believes the near-term uptrend status of Nifty remains intact. "There is a possibility of short-term consolidation or range movement for the next 1-2 sessions before resuming its upside momentum in the coming sessions. Immediate support is placed at 21,550 and the next upside targets are to be watched around 22,000-22,200 levels," Nagaraj said.

Ajit Mishra, SVP - technical research at Religare Broking also sees some consolidation in the Nifty in initial sessions next week, after gaining 8 percent in December.

However, the Nifty 50 has the potential to inch gradually towards the 22,150 zone. So traders should use the consolidation phase to add quality names on dips, he advised.

However, the broader markets outperformed benchmark indices and the breadth was slightly in favour of advances. The Nifty Midcap 100 and Smallcap 100 indices gained 0.8 percent and 0.6 percent respectively.

Story continues below Advertisement

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

The pivot point calculator indicates that the Nifty is likely to see immediate resistance at 21,762, followed by 21,784 and 21,820 levels, while on the lower side, it can take support at 21,691, followed by 21,668 and 21,633 levels.

Nifty Bank

On December 29, the Bank Nifty almost erased all its previous day's gains and fell 216 points to 48,292, forming small-bodied bearish candlestick pattern on the daily charts, indicating profit booking at higher levels, while on the weekly scale it formed a bullish candle and structure of higher lows is intact from the past five weeks as larger trend seems to be strong with buy on dips stance.

"Index gave the highest ever weekly close and now it has to continue to hold above 48,000 levels to make an up move towards its recent life high of 48,636, then 49,000 levels, while on the downside support is expected at 48,000 then 47,750 levels," Chandan Taparia, senior vice president | analyst-derivatives at Motilal Oswal Financial Services said.

As per the pivot point calculator, the Bank Nifty is expected to see resistance at 48,435, followed by 48,526 and 48,673 levels, while on the lower side, it may take support at 48,140, followed by 48,049 and 47,901 levels.

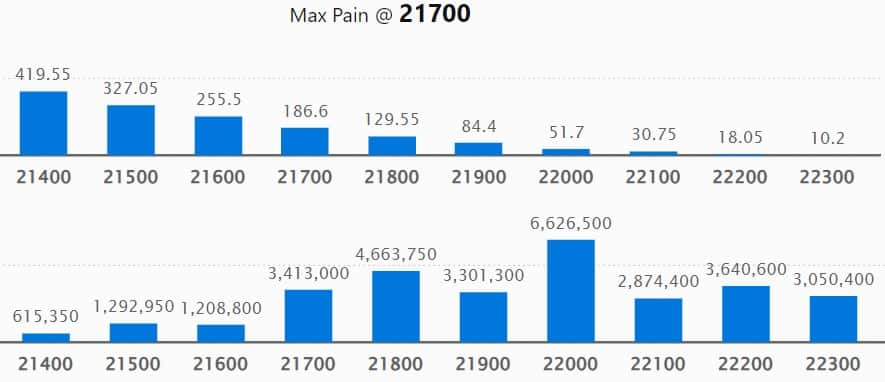

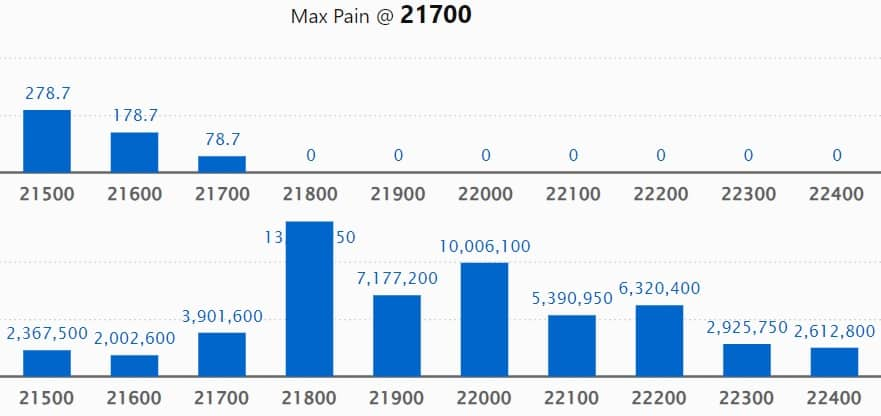

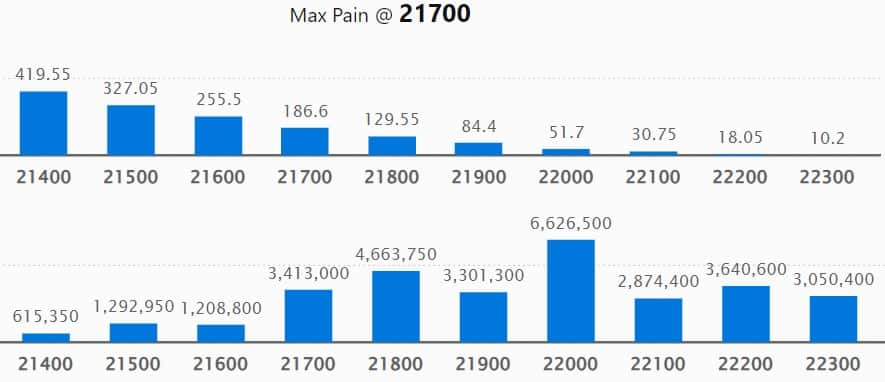

Call options data

As per the weekly options data, the 22,000 strike owned the maximum Call open interest, with 66.26 lakh contracts, which can act as a key resistance level for the Nifty in the short term. It was followed by the 22,500 strike, which had 61.02 lakh contracts, while the 23,000 strike had 59.32 lakh contracts.

Meaningful Call writing was seen at the 23,000 strike, which added 30.52 lakh contracts followed by 22,000 and 22,500 strikes, which added 28.51 lakh and 22.29 lakh contracts, respectively.

The maximum Call unwinding was at the 22,100 strike, which shed 1.82 lakh contracts followed by 21,600 and 21,000 strikes, which shed 66,050 and 52,400 contracts.

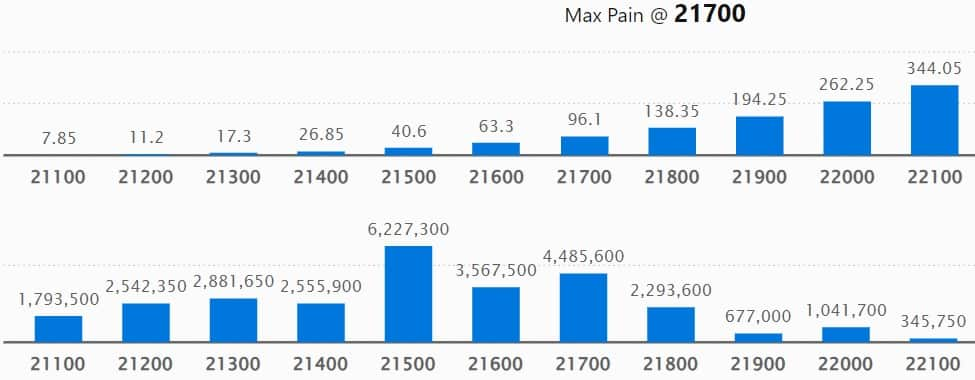

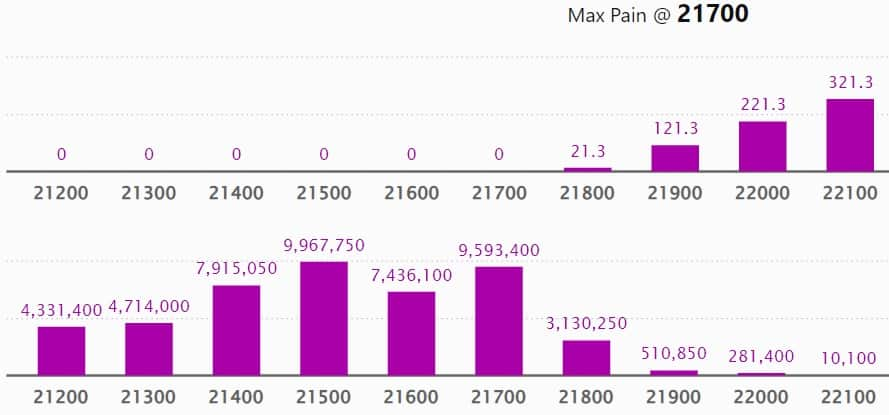

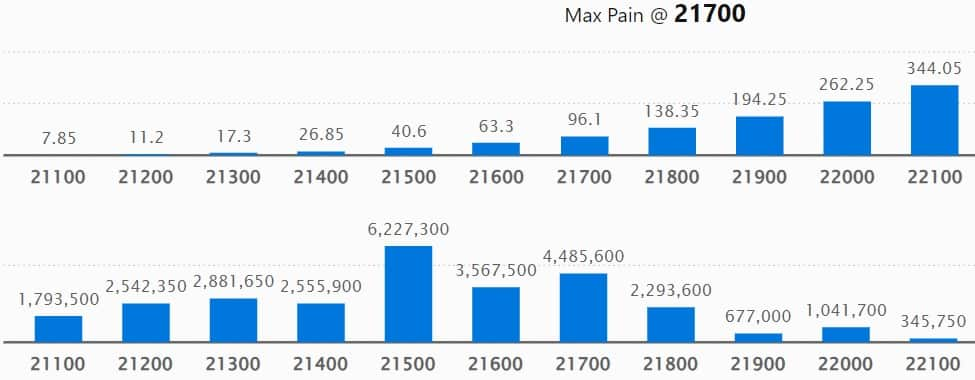

Put option data

On the Put front, the maximum open interest remained 21,500 strike, which can act as a key support area for the Nifty with 62.27 lakh contracts. It was followed by 21,000 strike comprising 45.86 lakh contracts and 21,700 strike with 44.85 lakh contracts.

Meaningful Put writing was at 21,500 strike, which added 21.16 lakh contracts followed by 21,700 strike and 21,200 strike, which added 20.55 lakh contracts and 14.07 lakh contracts, respectively.

There was no Put unwinding in the strikes from 20,100 to 23,000.

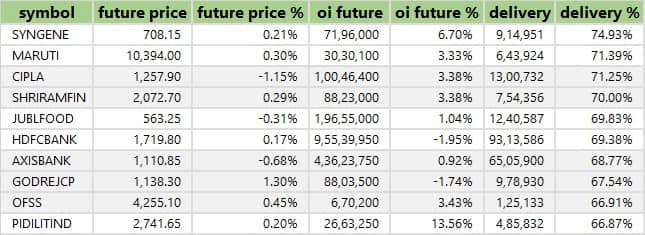

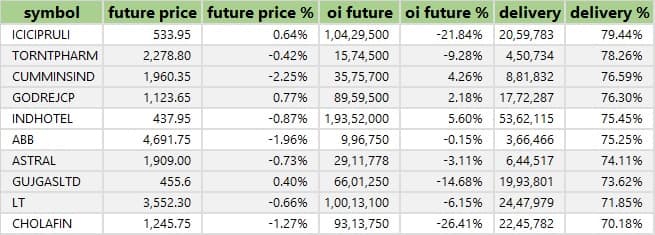

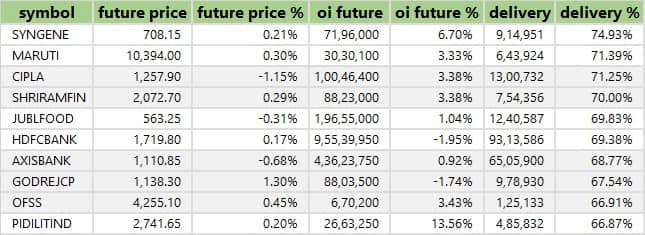

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. Syngene International, Maruti Suzuki India, Cipla, Shriram Finance, and Jubilant Foodworks saw the highest delivery among the F&O stocks.

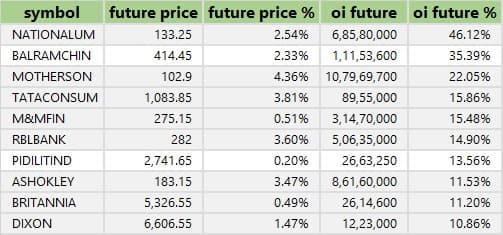

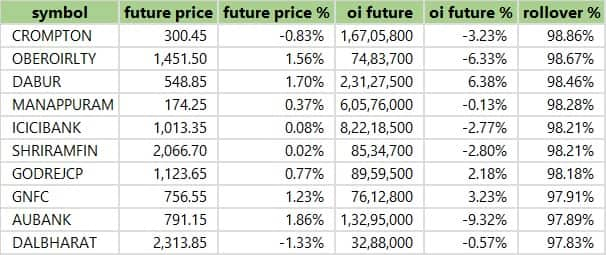

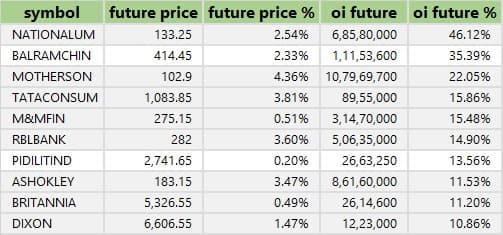

103 stocks see a long build-up

A long build-up was seen in 103 stocks, which included National Aluminium Company, Balrampur Chini Mills, Samvardhana Motherson International, Tata Consumer Products, and M&M Financial Services. An increase in open interest (OI) and price indicates a build-up of long positions.

20 stocks see long unwinding

Based on the OI percentage, 20 stocks saw long unwinding, including Hindustan Petroleum Corporation, IndusInd Bank, Bharat Petroleum Corporation, Oberoi Realty, and Coal India. A decline in OI and price indicates long unwinding.

39 stocks see a short build-up

A short build-up was seen in 39 stocks including IndiaMART InterMESH, Birlasoft, State Bank of India, ITC, and SBI Cards & Payment Services. An increase in OI along with a fall in price points to a build-up of short positions.

24 stocks see short-covering

Based on the OI percentage, 24 stocks were on the short-covering list. This included Hindustan Copper, Torrent Pharmaceuticals, MCX India, L&T Finance Holdings, and Hindustan Unilever. A decrease in OI along with a price increase is an indication of short-covering.

PCR

The Nifty Put Call ratio (PCR), which indicates the mood of the equity market, fell further to 1.12 on December 29, from 1.30 levels in the previous session. The above 1 PCR indicates that the traders are buying more Puts options than Calls, which generally indicates an increase in bearish sentiment.

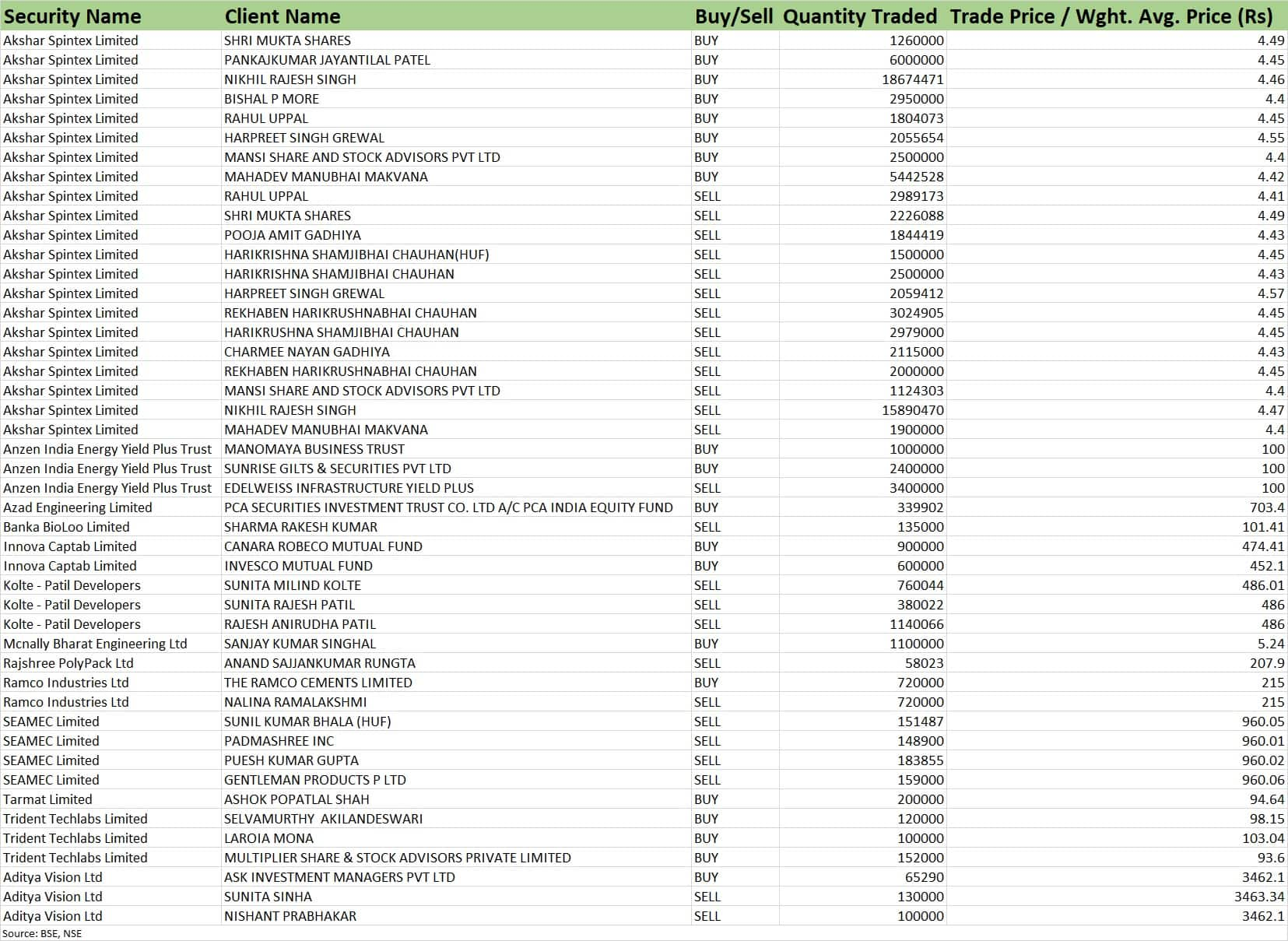

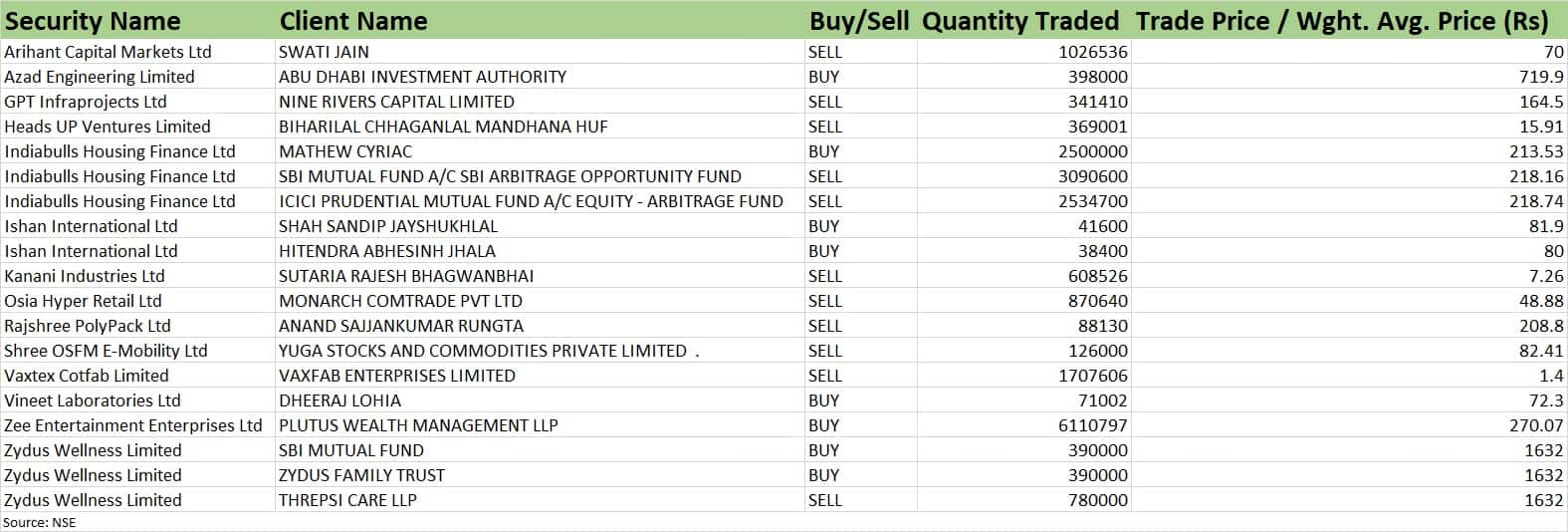

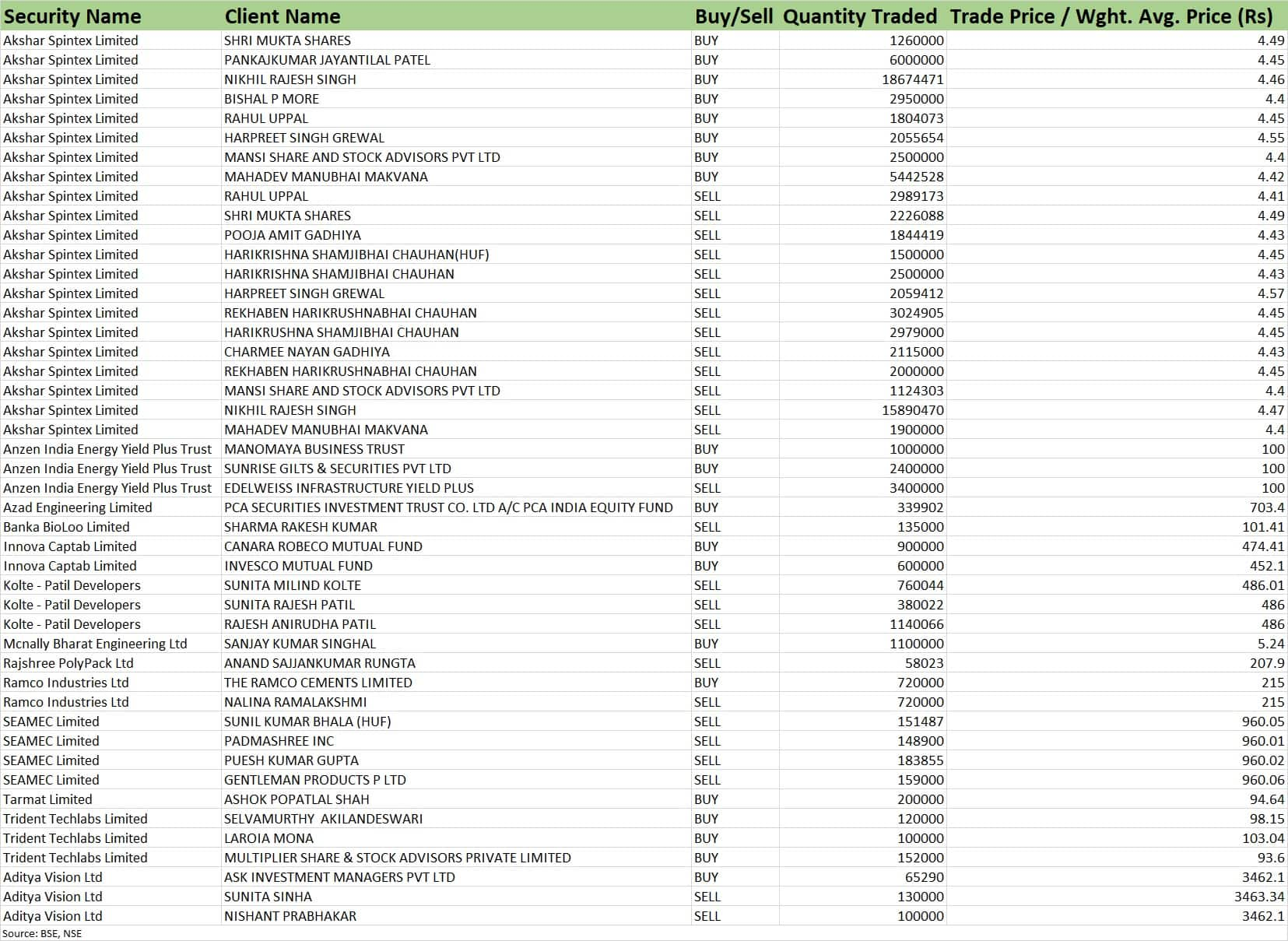

Bulk deals

For more bulk deals, click here

Stocks in the news

Karur Vysya Bank: The Reserve Bank of India has granted approval to ICICI Prudential Asset Management Company (ICICI AMC) for acquiring up to 9.95 percent of the paid-up share capital or voting rights of Karur Vysya Bank.

Grasim Industries: The chemical division of the Aditya Birla Group company has commissioned an additional 1.23 lakh tonnes of annual capacity of advanced materials (epoxy resins and formulation) manufacturing capacity at Bharuch, Gujarat. With this expansion, the total capacity of advanced materials is 2.46 lakh tonnes per annum. The expansion will facilitate the growth in speciality chemical business of the company.

Dr Reddy's Laboratories: The step-down subsidiary Dr Reddy’s Laboratories, Inc has acquired 10,14,442 preferred A-1 shares of Edity Therapeutics, an Israel based development stage biotechnology company, equivalent to 6.46% of the shareholding of Edity on fully diluted basis. These shares are bought for $2 million.

SBI Cards and Payment Services: Shareholders have approved an appointment of Nitin Chugh as Nominee Director on the board of the company with effect from October 4, 2023. Nitin serves as Deputy Managing Director and Head of Digital Banking at State Bank of India.

Nippon Life India Asset Management: Prateek Jain has resigned as Chief Financial Officer of the company due to personal reasons, with effect from December 29.

Macrotech Developers: The Deputy Commissioner of State Tax, Mumbai has raised Central Goods and Service Tax demand for Rs 91,60,63,334 including tax liability amounting to Rs 34,43,84,712 pertaining to July 2017 to March 2018.

Bondada Engineering: The company has received board approval for acquisition of 60% stake in Atpole Technologies, the leading manufacturer of advanced torque motors and controllers for EV 2&3 wheelers, drones, defence and industrial application motors, for Rs 2.19 crore. Post this transaction, Atpole will become subsidiary company of Bondada Engineering.

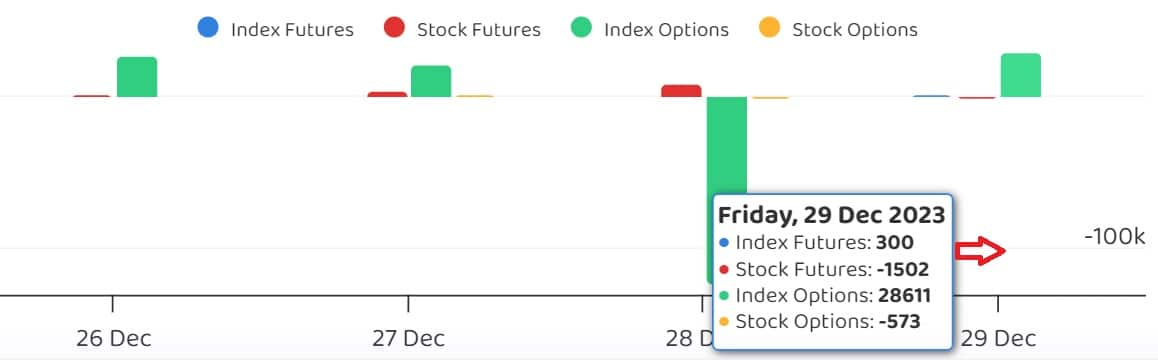

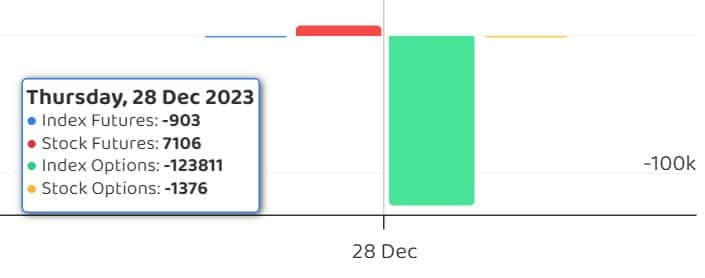

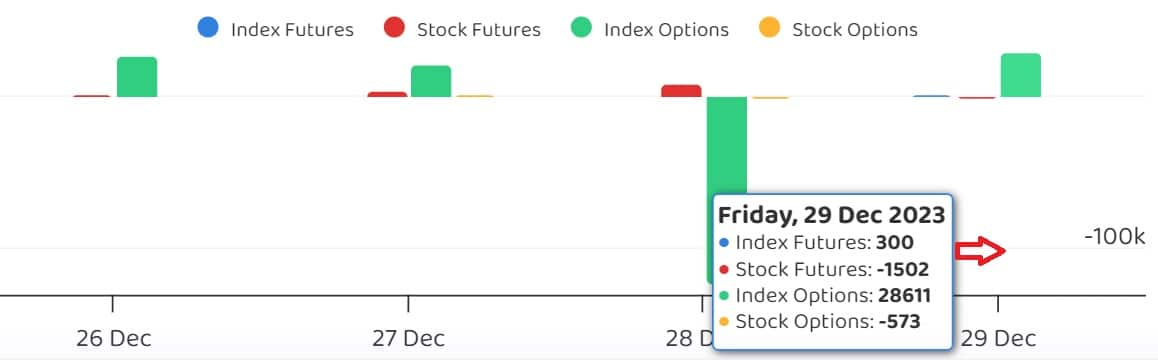

Funds Flow (Rs crore)

FII and DII data

Foreign institutional investors (FIIs) bought shares worth Rs 1,459.12 crore, while domestic institutional investors (DIIs) purchased Rs 554.39 crore worth of stocks on December 29, provisional data from the NSE showed.

Stock under F&O ban on NSE

The NSE has added Hindustan Copper to its F&O ban list for January 1.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.

Disclaimer: Moneycontrol is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Adblock test (Why?)

"trade" - Google News

December 31, 2023 at 08:33PM

https://ift.tt/dYnS9gh

Trade setup for Monday: 15 things to know before opening bell - Moneycontrol

"trade" - Google News

https://ift.tt/HbLnPpD