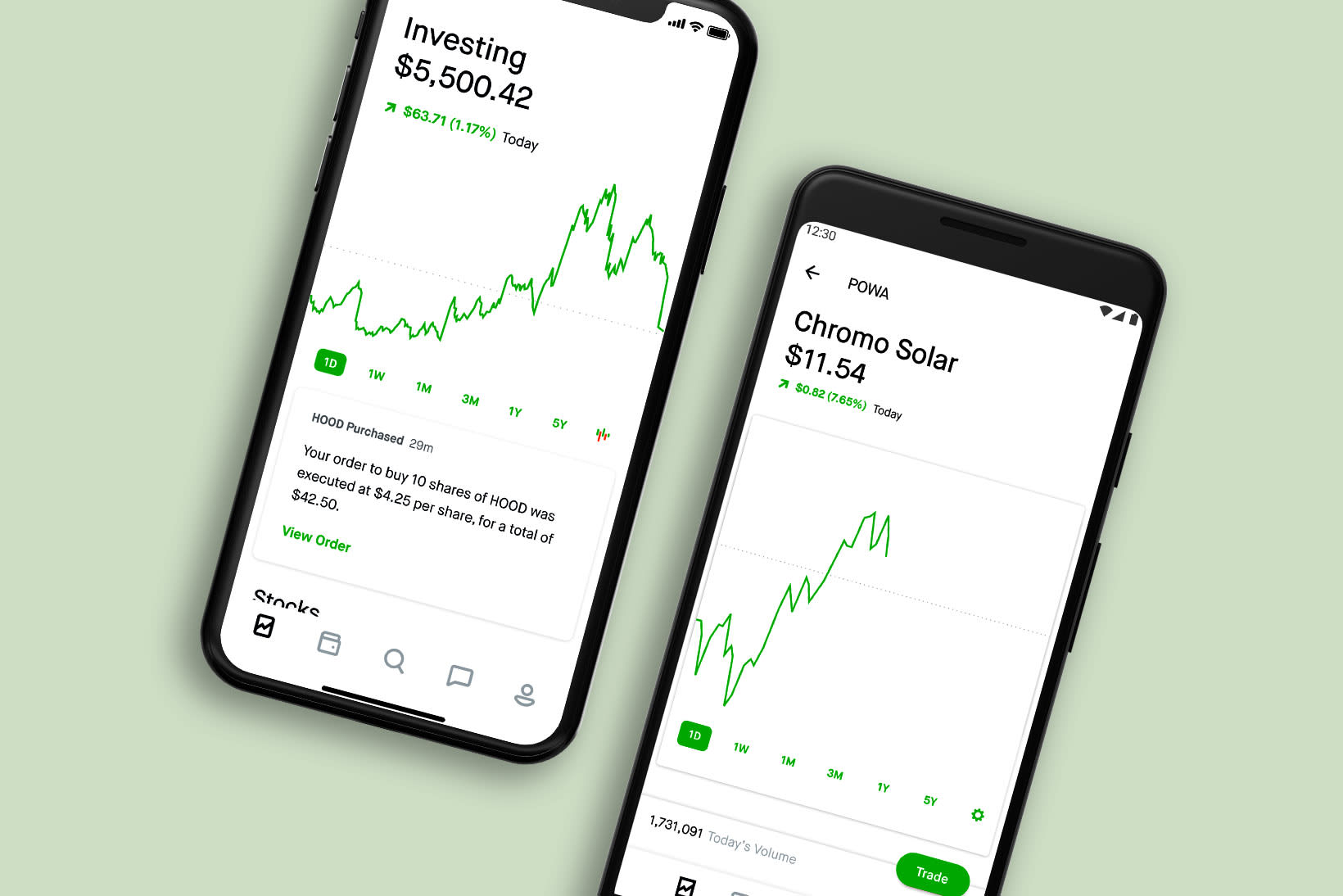

Robinhood app

Source: Robinhood

Robinhood joined the rest of brokerage industry by publishing monthly trading data on Manday. The start-up trounced them all — at least by one metric.

Robinhood saw 4.3 million daily average revenue trades, or DARTS, in June, the company told CNBC Monday. This is the first time the start-up has shared monthly totals. Robinhood's debut total was higher than all of the major incumbent brokerage firms, and more than E-Trade and Charles Schwab combined.

TD Ameritrade saw the next highest monthly total at 3.84 million DARTs, according to the company's monthly report. Interactive Brokers saw 1.8 million DARTs in June, followed by Charles Schwab and E-Trade at 1.8 million and 1.1 million, respectively.

So-called DARTs are still a key brokerage industry standard for measuring customer trades, even though they no longer charge commissions. Robinhood's DARTs in the entire second quarter more than doubled compared to the prior three months, according to the company. All three of its top days based on trading volume, happened in June 2020.

The new disclosures, first reported by Bloomberg, come just days after Robinhood announced it was taking some customer data off of its site. A Robinhood spokesperson told CNBC it would no longer publish the number of clients holding a particular stock because that data was often "misconstrued" and "misunderstood," and was not representative of how the customer base uses Robinhood. It also plans to restrict access to its API, which had been used by third-party sites like RobinTrack.com to show retail interest in stocks such as Virgin Galactic and Kodak.

"When we look at customer behavior over time, many Robinhood customers use a 'buy and hold' strategy," a Robinhood spokesperson said, adding that as customers spend more time on the platform "most of them buy more stocks than they sell."

Robinhood has had a banner year with 3 million new customer accounts in the beginning of 2020. It also announced the close of a Series F funding round that pushed its valuation to $8.6 billion. Still, Robinhood has had its share of growing pains. For one, the start-up experienced multiple days of outages in March, which it attributed in part to record trading volume and volatility. Robinhood also made it more difficult to get access to its options offering in the wake of a customer's suicide.

Robinhood is hardly the only trading firm seeing record growth. All of its publicly traded rivals more than doubled their trading volume year over year in the second quarter. TD Ameritrade saw the largest increase in DARTs, at 312% from the comparable quarter last year.

"trade" - Google News

August 11, 2020 at 04:32AM

https://ift.tt/31H9TZp

Robinhood reports more monthly trades than rivals Charles Schwab, E-Trade combined - CNBC

"trade" - Google News

https://ift.tt/2VQiPtJ

Tidak ada komentar:

Posting Komentar